There is no exciting news for EURUSD right now, except the US ADP index due for publication today is often seen as an indicator for the US labor market report two days later, and if the index provided a surprise it could create some momentum for USD this afternoon.

However, as far as the long-term interest rate expectations are concerned new jobs are not what matters but whether low unemployment is eventually reflected in rising prices. So far that is not the case, as there is a lack of strong wage pressure in the US too. As a result what matters most to the FX market next week is how the FOMC members judge the inflation development.

In the process, the dots, which reflect the individual member’s rate expectations, might be revised slightly to the downside in the long end as many FOMC members have become more doubtful about a sustainable rise in inflation over the past weeks and months.

That, in turn, would confirm the market in its view that the Fed will not hike interest rates as often as it is signaling next year and will put pressure on the dollar. A Fed rate hike next week, on the other hand, is almost entirely priced in and is therefore unlikely to have a significant effect on USD.

Buy dual digital call on EURUSD and USD rates

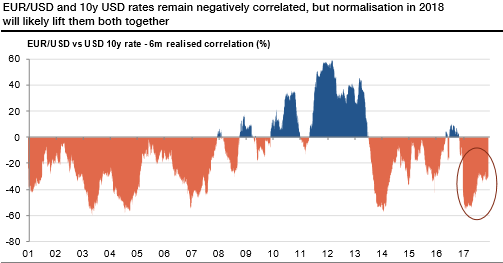

With the correlation between EURUSD and USD 10y rates negative (-30% in the past six months, refer above graph), a dual digital pay-off requiring both of them to move up should cheapen.

Thanks to the negative correlation between EURUSD and the USD 10y rate, this hybrid option is cheaper than the product of the individual digital call premiums.

In the US, 10y IRS recovers to 2.37% in Asia, return above 2.40% subject to NFP outcome tomorrow. S&P warns over fiscal loosening due to tax cuts could spell rating action as the Senate and House target final tax bill before 22 Dec deadline.

Buying the usually negative correlation between EURUSD and dollar rates does not mean that it must become positive for the trade to perform.

Correlations are computed between short-term returns, so EURUSD and the USD 10y CMS could rise together even if the correlation stays negative.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis