The Fed unsurprisingly delivered the sixth rate hike in the current cycle. The target range for the federal funds rate is now at 1.50%-1.75%. Considering the recent hawkish turn in Fed communications, markets were more interested in the economic projections of meeting participants. And, indeed, policymakers now see stronger growth and a lower unemployment rate. For 2018, the dot plot still indicates three rate hikes, but the rate path for next year is now somewhat steeper.

The robust US dollar depreciation realized since mid-December seems to have been stopped for now and most recently the US currency was able to regain some lost ground again. There is only one currency in the G10 universe that did considerably well since early February and that is the Japanese yen. JPY’s outperformance for the past three weeks has been remarkable: JPY appreciated to the highest level in 6 months in nominal weighted terms.

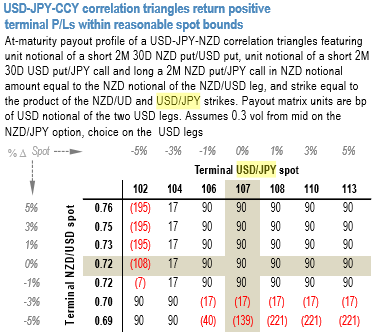

If at all USDJPY is projected to slide towards 100 on following driving forces, the below options strategy is advocated on hedging grounds.

A likely by-product of the loss of USD momentum is a pause or even a modest reversal in USD-correlations that have surged this year due to across-the-board dollar weakness. We do not expect any de-correlation to be very pronounced given the primacy of US monetary and fiscal policy in driving FX movements in 1H’18 before other G3 central bank actions assume greater importance later in the year.

Hence ‘hard’ de-coupling option constructs – for instance, dual digitals or worst-of options with out-of-the-money strikes –are not high %age trades in our view despite the attractive implied correlation levels they sell.

Carefully constructed vanilla option triangles can be a viable alternative to exotic options as a mild USD correlation breakdown construct. For instance, one could sell USD puts/JPY calls and USD calls/CAD puts (in equal USD notionals) but hedge out the resultant long CADJPY delta risk by simultaneously buying CAD puts/JPY calls of the appropriate strike (the equivalent cross-yen strike derived from the two USD leg strikes) and in appropriate notional amounts (equal to the yen notional of the USDJPY leg).

Because they involve selling two options and buying one, these triplets entail earning premium at-inception; and because ‘closing the delta loops’ of the triangle leaves little or no directional exposure to begin with, overt spot divergence is not a pre-requisite for retaining the upfront premium credit.

A scenario grid of spot levels at maturity helps visualize terminal payout outcomes; such an exercise for a USD-JPY-NZD triangle for instance shows that returns are positive in most states of world within (subjectively) sensible bounds of terminal spot, not only in the anti-correlated quadrants of the grid but also in significant portions of the rest of the table where traditional de-correlation structures fail (refer above nutshell).

Currency Strength Index: FxWirePro's hourly USD spot index has turned -132 (which is highly bearish), while hourly JPY spot index was at -17 (mildly bearish), NZD is flashing -56 (bearish) and CAD at 71 (bullish) while articulating at 07:35 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data