USDCHF failed twice in 2015 and 2017 to clear key pivotal resistance at 1.0343, now struggling to hold 2017 October highs which inherited the risk of having formed the range bounded trend. You could make out the intermediate trend has been oscillating between 1.0343 and 0.9071 levels.

While both USDCHF and EURCHF's lower IVs with bearish neutral delta risk reversals could be interpreted as the option writer’s opportunity in short run. Thus, exploiting on lower IVs we eye on shorting puts with shorter expiries which would lock in certain yields by initial receipts of premiums.

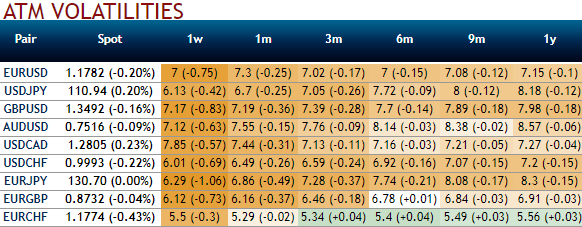

The 1m implied volatility is a tad below 6.5% and 5.3% for USDCHF and EURCHF respectively along with bearish neutral risk reversal sentiments, accordingly we construct multiple legs of option strategy for regular traders of this currency cross when there is little IV. While positively skewed IVs are well balanced that stretched on either side (both OTM calls and OTM puts are on upper hand).

A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

One can execute this strategy using options expiring on the same expiration month, the options trader creates an iron condor by selling a lower strike OTM put and buying an even lower strike out-of-the-money put, similarly shorting a higher strike OTM call and buying another even higher strike out-of-the-money call. This is likely to result in a net credit to put on the trade.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -6 levels (which is neutral), USD flashing at -18 (neutral), while hourly CHF spot index was at a tad below -2 (neutral) while articulating (at 11:44 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation