As expected, the MXN plunged on Trump’s victory. We had warned previously that the MXN was not pricing much in terms of excess premium going into the US election, which explains the move higher in USDMXN following the outcome (+13.2%).

Admittedly, we erred in entertaining a more aggressive policy reaction. The authorities preferred to gain time by standing pat, although they clarified they are ready to act if need be, via discretionary FX intervention and intra-monetary meeting policy decisions.

While we believe the authorities might react if USDMXN were to move above 21.1-21.5, it seems the reaction may not be as aggressive as we had entertained (up to 100bp in policy rate hikes). Indeed, the analysts call for Banxico to hike once before the end of the year, and a 50bp rate increase next week seems more likely than waiting until December.

While waiting for the policy reaction, we note that the uncertainty pending on US trade policies, exacerbated by tighter global financial conditions suggests the MXN is not cheap at current levels.

True, short-term valuation models, which rely on historical co-variances of USDMXN and coincident risk indicators, suggest MXN 2.5-3.0% cheap. Yet, we believe that premium is not enough in case the newly elected US administration decides to pull the trigger on severe protectionist measures (i.e. leaving NAFTA).

Most notably, after the recent USD rally caused by Donald Trump’s election victory and based on rising inflation and interest rate expectations continued, the new phase of dollar rallies is still on the cards as the Fed’s Christmas easing is nearing little early

Short Term Hedging Perspectives:

USDMXN has declined from the highs of 21.3915 to the current 20.4911 levels; loss of almost 4.39% in last three days and technicals indicates major uptrend seems intact but slightly indicative of further dips in short run.

Well, it would be wise to contemplate both above fundamentals and technical indications of the extensive bearish trend of USDMXN and married puts are recommended to the existing spot long exposures of this pair in order to hedge the further potential slumps of this pair.

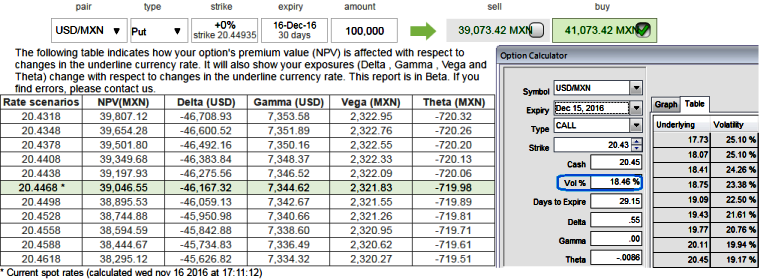

So, as shown in the diagram, this is the option strategy in which the Mexican foreign traders who have their dollar receivable exposures are suggested to buy an at the money put option of 1m tenors while simultaneously buying an equivalent notional amount of the underlying spot FX.

Since purchasing a protective put gives you the right to sell underlying pair at the predetermined strike price, there wouldn’t be any potential threat for this exposure regardless of underlying spot rates.

1m ATM IVs are trending above 18.46% which is quite conducive for option holders when underlying spot keeps plummeting in next 1 month, this is evident in payoff structure during various underlying rate scenarios.

The strategy is typically employed when the foreign trader is having exposure on the dollar receipts, and he doesn’t want to take any FX risks, but wary of uncertainties in this span of one month.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty