We could foresee short-term gains and bullish trend resumption in long-term trend contemplating valuation models and technicals.

In our recent technical write-up, we’ve analyzed and stated USDMXN’s short term weakness and major bullish trend resumption. Visit below weblink for more readings:

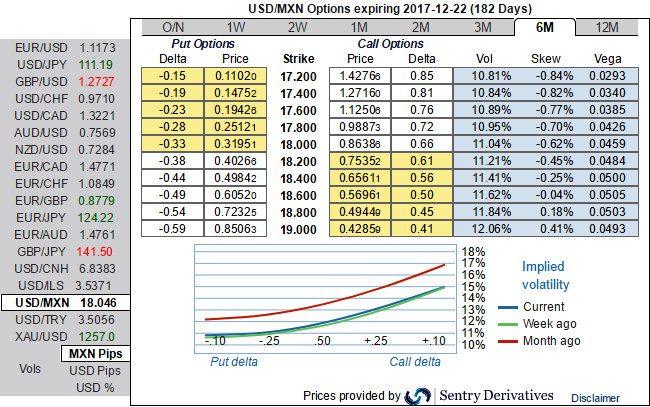

Stay neutral with the currency seeming rich to our short-term valuation models. We recently revised the MXN forecast higher and now expect the USDMXN at 18.50 and 18.80 by December and June respectively, from 19.75 for March before.

The more constructive outlook responds to better fundamentals with the balance of payments already showing stabilization and our view that politics will remain calm into 2H following State of Mexico elections.

That said, the peso is trading rich to short-term valuation models (refer above diagram) and positioning seems heavy for the MXN, with IMM data showing long MXN positions at the highest level since June of 2014 (refer above diagram).

We prefer to receive rates instead of being long MXN for a bullish view in Mexico.

OTC indications and Options strategy:

Please be noted that the negatively skewed implied volatilities of USDMXN of 6m tenors indicate neutral hedging sentiments (refer above diagram).

Well, these fundamentals, technicals, and skews suggest credit call spreads that are likely to favor both downswings in short run and major uptrend.

At spot reference: 18.049, one can deploy diagonal credit call spreads by writing 2m (1%) in the money call while initiating longs in 6m at the money call, the structure could be constructed at the net credit.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary