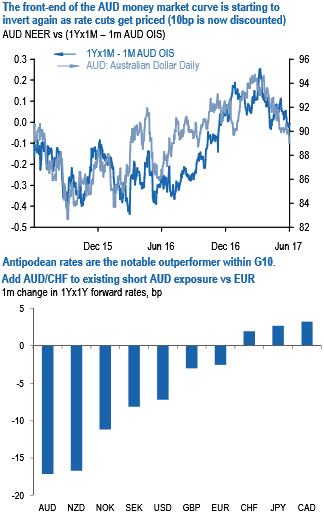

AUD money markets rates have rallied by more than any other G10 currency over the past month (see above chart). In the process, the front-end of the curve has inverted again as rate cuts have started to be priced again (roughly 10bp is now priced in – see above chart). The RBA is unlikely to offer any additional encouragement for rate bulls or AUD bears at next week’s policy meeting as we expect it to stick to its broadly neutral tone of recent months.

Nevertheless, we believe negative momentum in AUD is durable as this is being driven by a confluence of fundamental forces that are both diverse as well as persistent, namely evidence of a downturn in the domestic credit cycle that is manifesting itself in weaker housing market indicators and the performance of bank stocks, together with external factors including the ongoing slide in metals prices and the continued reservations about the Chinese growth cycle (the two are obviously in part inter-related). European currencies are on the other side of the cyclical divide and while growth expectations are no longer being upgraded as powerfully as they were, the delivery of strong growth in the region should sustain an ongoing upgrade in what remain structurally cheap currencies.

We see no reason not to include CHF in this category of undervalued currencies. We accept that this assessment is controversial but in support of this we merely cite the massive intervention the SNB has needed to undertake to prevent a more aggressive appreciation in the currency. Intervention this year is running at twice the pace of last year and nearly 70% greater than the current account surplus. Official intervention may constitute a-priori evidence of a currency undervaluation, but at the same time of course it also implies the currency is not free to appreciate so long as the SNB continues to sell.

What consequently is significant for CHF, and why we are increasing CHF exposure, is evidence that the SNB is finally tapering its intervention activities following the safe passage of the French election(what possible pretext would it have to intervene now that political risk has abated?). Average intervention over the past two weeks has dropped to only CHF 0.5bn. This is the slowest rate of intervention since last December and barely a fifth of the peak rate of intervention around the French election (chart 4). The official door for CHF appreciation seems ajar.

Sell AUDCHF at 0.7170 with a stop at 0.7320.

Stay long EURAUD from 1.4840 May 5th. Marked at +1.96%. Raised stop to 1.50.

Sold USDCHF at 0.9782 on May 18. Marked at +1.48%. Lowered stop to 0.9750

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch