Federal Reserve is lined up next for its monetary policy announcement, there is no rate hike expected today and the data have not changed much since the forecast update at the June meeting. During the afternoon, the ADP Report will give us a foretaste of strong official labour market figures due on Friday, and the ISM index looks set to underline buoyant economic sentiment. Hence, a rate hike in September appears to be a foregone conclusion. However, it is clear that this pattern (a rate step every three months) will not continue forever. The Fed estimates the “neutral interest rate” (i.e. a rate which is neither expansionary nor restrictive) at just below 3%.

Gold has resumed its business for the day nudging prices below 7DMA levels, it has slid from day highs of $1,224.71 to the current $1,221.35 levels.

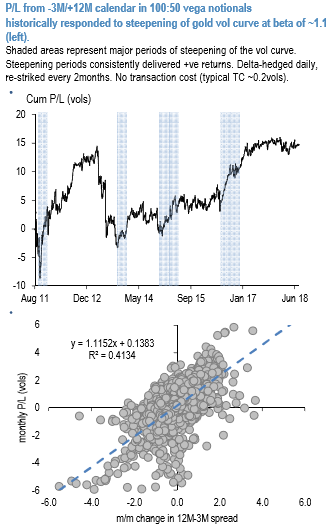

For the historical performance of XAUUSD vol calendars, the above chart explains a consistently good track record during vol curve steepening episodes, with 1.1 beta of returns to vol pts of steepening. 12M-3M should widen by about 1.1vols in order to mean-revert to its 1Y average (from the currently 2 sigma too narrow gap); a rough assessment of the mean reversion speed of the vol spread places its half-life at around 2.5 weeks which, being well below the maturity of the short leg of the spread, should give enough time for the term-structure dislocation to correct. Moreover, at the current market, the structure is showing 2 vols of vol carry from the short front end straddle.

Please be noted that the IV skews of gold are well balanced (refer above nutshell), XAUUSD contracts are stretched towards both OTM call and OTM puts. Accounting for both P/L components (vol curve and implied-realized gap) in a multivariate historical regression we estimate >1.6 vols of potential gain, while 1Y @10.7 vols and at a historical low should limit the downside. With the latest positive turn in trade developments, one potential near-term risk to the short front vol leg that still remains is the Friday GDP print. Still, given the tight risk-reversals, implying a spot/vol correlation near zero (at 7%), large moves in the spot should not overly impact the front-end of the curve and trigger a further tightening of the 1Y-1M spread.

Overall, to recapitulate, with the current gold surface dislocation mostly concerning the elevated front end vols and a sizeable implied-realized gap we overweight the short vol front leg: Sell 3M @9.45 choice vs buy 1Y @10.3/10.65 indic XAU/USD straddles in 100:50 vega notionals, keep delta-hedged. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index has turned -58 levels (which is bearish), while articulating (at 12:04 GMT). For more details on the index, please refer below weblink:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure