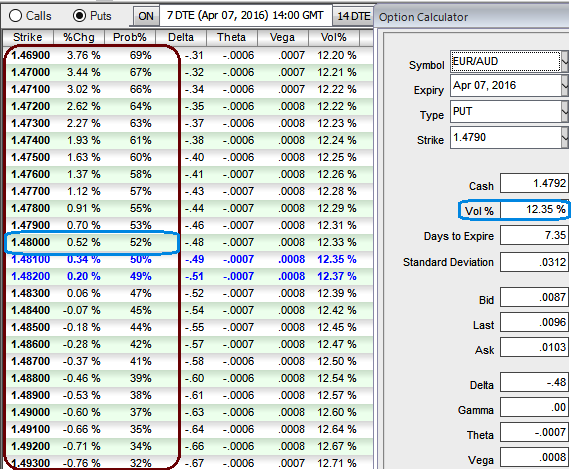

The current EURAUD ATM implied volatilities are observed at 15.04% (1D) and 12.35% for 1W tenors.

Ahead of data event in Eurozone, we see these higher volatility times in this pair.

We have list of important economic data events for today as lined below:

German retail sales that has produced disappointing numbers at -0.4%, a drop from previous -0.1%.

French consumer spending and monthly CPI, followed by Spanish retail sales, CPI and current balance. Later European session, we have Italian CPI followed by Euro area monthly CPI.

Technically, we see strong selling pressures from both leading and lagging indicators on both weekly and monthly charts as the pair forms bearish patterns such as double top and shooting star candles on weekly and monthly charts respectively.

Keeping above specified fundamental and technical aspects into consideration, AUD is likely to gain against euro in the weeks to come, but any upswings in abrupt should be capitalized eyeing on reduced IVs as writing opportunity so as to reduce the hedging cost.

Volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

So, here goes the recommendation this way, at current spot FX is trading at 1.4810, since we expect more dips extending below 1.46 levels in medium terms, aggressive bears can initiate strategy using ATM puts.

But unlike a simple naked puts, backspreads have an extra long that has not only leveraging effects, a short option at a lower strike that caps your reward but also reduces the net cost of the trade.

So, the recommendation for now is to go long in 2W ATM -0.49 delta put, long in 1M (1%) OTM -0.39 delta put and simultaneously short 1W (1.5%) ITM put with positive theta.

Most importantly, you can very well observe from the diagram as to why we've preferred OTM strikes in our strategy. The sensitivity scenarios show that the high probabilities of these OTM strikes expiring in the money and their relevant %change in premiums, well yeah they are luring factors.

As the strikes have been narrowed, the profit potential is greater, so that the ratio needed is also lower to profit on underlying movement.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand