As the month of UK referendum begins, we could more chaos in euro and sterling crosses for next 1 - 3m tenors.

Especially, the implied volatilities of GBPUSD, EURGBP and EURJPY are taking eccentrically, these three pairs tops the latest watch list with IV rank.

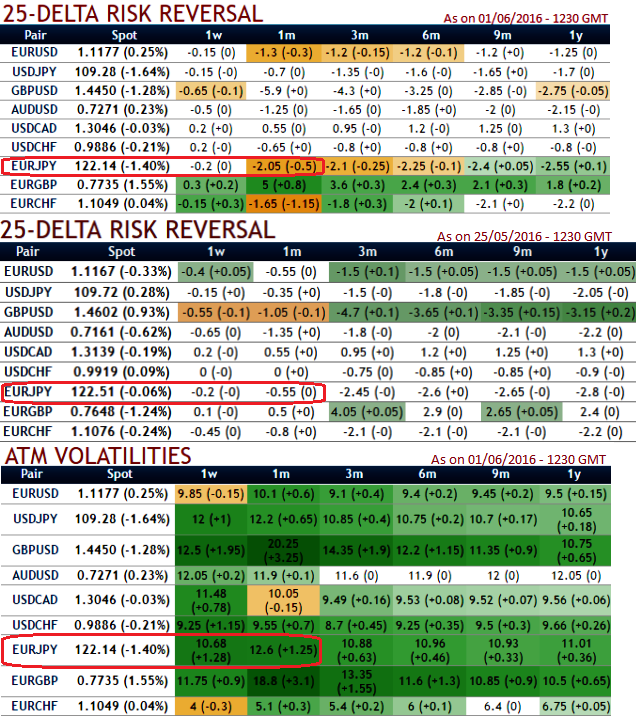

Emphasizing on EURJPY, we could foresee more downside risks in this pair, the same stance is also signalled by 1m risk reversals.

As ECB preparing for a new normal; unemployment to fall in Spain We expect no policy action from the ECB on Thursday but a small, and rare, upward adjustment to the staff inflation projections. See link below for more.

Hedgers seems to be willing to pay more on puts on spiking IVs amid uncertainties revolving around EURJPY. You can very well observe mounting sentiments from last week (25/05) to the current flashes for bearish risks of this pair.

A positive risk reversal would mean that the vols of OTM call is greater than that of the vols of similar puts, which implies that more market participants are betting on a rise in the price of the underlying security than on a drop, and vice versa if the risk reversal is negative.

We should understand one important thing in foreign-exchange trading, risk reversal is the difference in volatility (delta) between similar call and put options, which conveys macroeconomic market information used to make trading decisions.

In Spain, we expect a large decline in unemployed (-71.2K after -83.6) given favourable seasonal factors and still strong economic growth, but the drop since the beginning of the year should only reach 150K vs. 230K Jan-May last year. Service PMIs in Germany, Italy, France and Spain are scheduled to be announced.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate