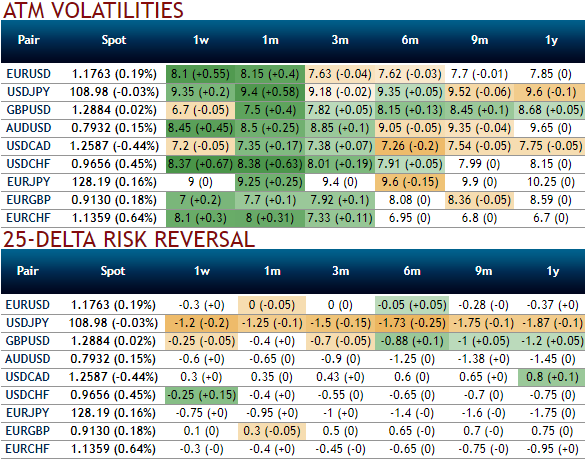

When we are strategizing hedging frameworks, we came across the implied volatility of ATM contracts across all tenors are spiking higher than 9.25%, the rationale is that all potential downswings should be optimally utilized to maximum extent regardless of trading or hedging grounds, so to participate in that downtrend, weights in the portfolio should be increased with more number of put contracts but consciously while choosing the right instruments.

Implied volatility is an important factor to consider in options trading because the prices of options are directly affected by it. A spot rate with a higher volatility will have either had large price swings or is expected to, and options based on a security with a high volatility will typically be more expensive.

Please be noted that the IV skewness is very useful in determining this decision, here in case of USDJPY, one could easily make out positively skewed IVs are signifying the importance of OTM puts. And also be noted that this bearish sentiment is also substantiated by the mounting negative risk reversals that again indicates further bearish risks.

Well, this is intuitive due to the higher likelihood of the market 'swinging' in your favor. If IV increases and you are holding an option, this is good. In contrast, if it goes in an adverse direction, then one should raise a cause of concern for his options strategy.

A smart approach to tackle this obstacle and potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. The simplest way to do this is to buy at the money contracts.

Delta neutral strategies are options strategies that are designed to create positions that aren't likely to be affected by small movements in the price of a security. This is achieved by ensuring that the overall delta value of a position is as close to zero as possible.

Delta value is one of the Greeks that affect how the price of options changes.

Strategies that involve creating a delta neutral position are typically used for one of three main purposes.

- Profiting from Time Decay

- Profiting from Volatility

- Delta Neutral Values in hedging

What makes ATM instrument more productive in our strategy: the delta of this instrument is here at its fastest rate and gets faster as your position comes closer to the expiration date. As a result, time decay may have a relevant impact on ATM options.

Hence, we deploy ATM instruments in our below recommendation.

The strategy reads this way:

Add longs in 2 lots of ATM -0.49 delta put option of 2m expiries, while one lot of writing 2w OTM put with positive Thetas. The strategy should be held with a view to arresting further downside risks.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics