Markets are focused on the FOMC minutes and US labor market prints. A weak headline jobs print, with soft wage growth will reinforce the weaker USD trend of late.

Yesterday, we saw mixed bag numbers in manufacturing sales, US CPI and building permits.

However, a weak headline jobs number with solid wage growth could signal capacity constraints. With markets pricing very little chance (10%) of a June rate hike, and just north of 50% chance of 1 hike this year there is room for upside and downside surprises.

On the flip side, RBNZ doesn’t really seem to have eased their economy by reducing 25 bps OCR in last month end or it may take time to factor in this monetary policy decision as GDP (q/q), GDT price index, manufacturing PMIs have reduced considerably and unemployment rates have increased on the other side.

Market pricing assigns a 50% chance of the RBNZ cutting on 9 June, 2 days after a probably steady RBA. But the latter is not a sure bet, leaving plenty of scope for movement in the 2 year spread.

OTC outlook & Hedging Frameworks:

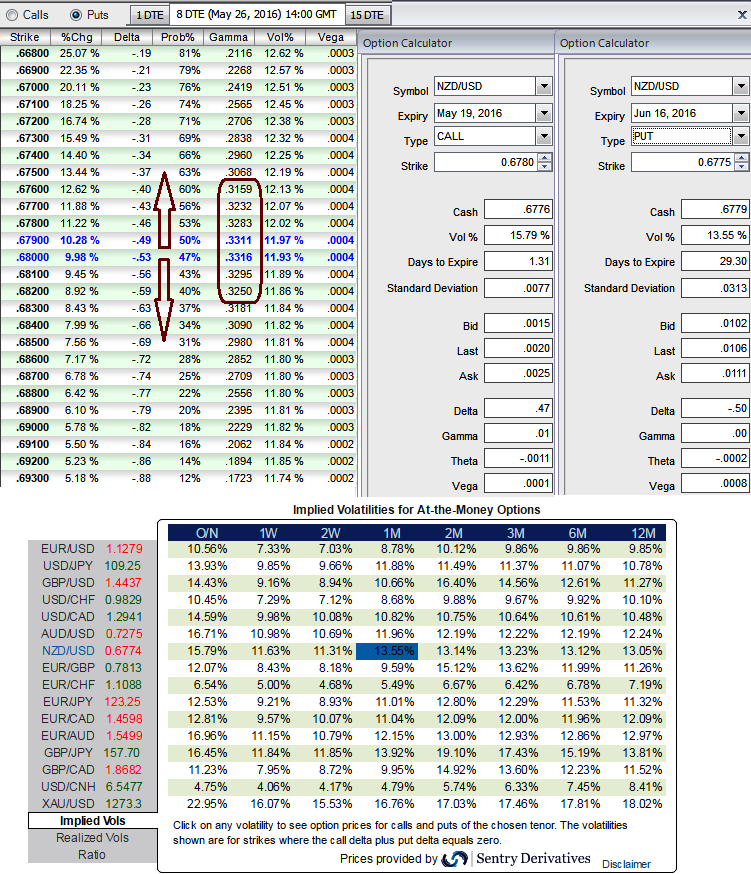

1W ATM IVs are at 11.63% and 13.55% for 1m tenors.

If you look at the sensitivity table also for the different rate scenarios and their probabilistic outcomes, OTM put strikes with higher probabilities and higher gamma would mean that during higher volatility times, these strikes are most likely to finish in the money on expiration.

We've just referred 0.25% OTM put strikes and their vols, it still shows 0.47 as delta values for underlying outrights with 52% of probabilities, that means 52% chances of finishing in-the-money which is why for demonstration purpose, as shown in the figure we consider the NZDUSD ATM instruments while formulating option strips strategy at spot FX ref: 0.6837.

Hence, Weights are to be more to favour downside risks, as a result, we recommend holding 2W at-the-money 0.51 delta call and simultaneously hold 1 lot of 1M at-the-money -0.49 delta put options and 1 lot of 2M (1%) Out-Of-The-Money -0.36 delta put option.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise