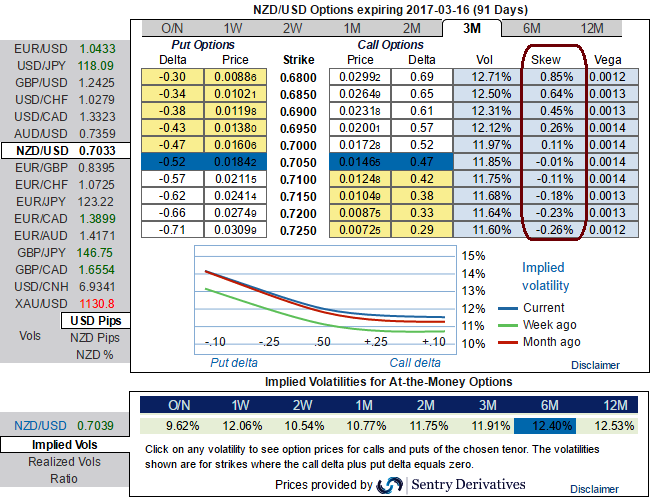

Please be noted that the 3m IV and skews of NZDUSD is pretty much in tandem with FED’s forward guidance. By that, we mean dollar would gain considerably against NZD in Q1’2017.

NZDUSD 1-3 month: Below 0.6970. The US dollar has had an impressive rise since the US election and has the potential to rise further during the months ahead. The Fed’s assertive tightening projections plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar. Against that, the NZ economy is strong and dairy prices have risen, but these forces are subservient to the US dollar’s trend.

On Valuation terms: NZD remains overvalued; NZD TWI strength is the major concern, together with downside risks to global growth. But TWI strength is not solely yield driven. Growth matters too and lowers interest rates are stimulating growth.

Momentum in NZDUSD swings has flipped to negative to evidence more bearish streaks, thanks to the US dollar’s been surging in the recent times, with the next major target at 0.6970 and even call for 0.6897.

Hence, we advocate 3m ATM -0.49 delta put options on hedging grounds. Unlike a trade in the underlying whose value per point stays the same, the value of an option for every point’s movement in the underlying is constantly changing. The Delta can be used to measure the value of an option as the market moves. This is useful to monitor directional risk so you may know how much your option’s value will increase or diminish as the underlying market moves.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data