RBNZ Preview:

We expect the Reserve Bank to hold the OCR at 2% next week. The kiwi has been one of the top performers this year despite two RBNZ rate cuts. The RBNZ’s current easing cycle started in June 2015, and the bank has cut the cash rate by 150bp since then. But NZD/USD’s appreciation has occurred against the direction of interest rate differentials for months.

Why should we think OCR to remain on hold:

In August the RBNZ signalled that another cut in November was highly likely, with the possibility of a further cut beyond this.

Developments since August have been more or less balanced for the inflation outlook. GDP and dairy prices have risen more than expected, but the exchange rate is stronger

OTC outlook:

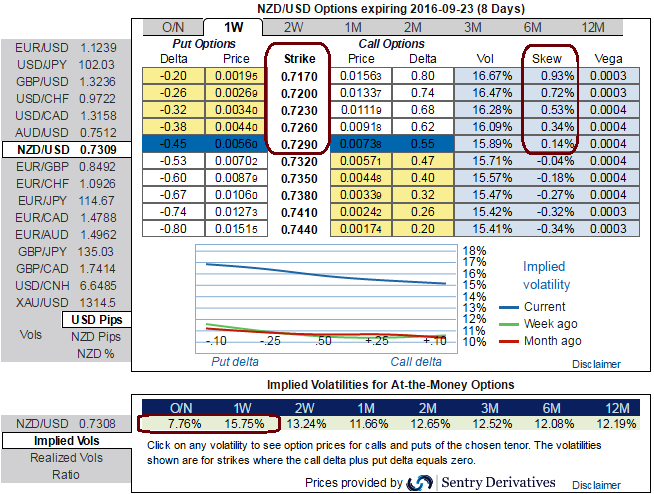

1W IVs are screaming off over 15.7% and positive skew is observed in OTM put strikes.

Implied volatility is elevated compared to realised volatility (Graph 2), suggesting a structure selling it. The downside skew is not sufficiently elevated to finance a put via low strikes (a put spread-like structure), but the negative skew is enough to obtain an attractive discount via a downside knock-out. Such a barrier is appropriate for trading moderate NZD/USD downside

Option Trade Idea:

Buy NZD/USD 2w put strike 0.7250 knock-out 0.70, indicative offer: 0.45% (vs 0.84% for the vanilla, spot ref 0.7320). As it sells convexity and volatility, this trade is intended to be a buy-and-hold position. The maximum leverage will be reflected in the market value only a few days before the expiry. In addition, volatility is likely to go up along with NZD weakness, suggesting getting rid of the vega related P/L and targeting only the option pay-off.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says