In RBNZ’s MPS, OCR was kept on hold at 1.75%, with a stronger signal that the next move will be up. Following the announcement, the New Zealand dollar fell 110 basis points to the current 0.6830 and the two-year swap rate fell 8 basis points.

On the back of RBNZ’s status quo monetary policy, bears of NZDUSD in the major downtrend have resumed after testing the stiff resistances of 0.7038 and 21EMA levels (refer daily charts).

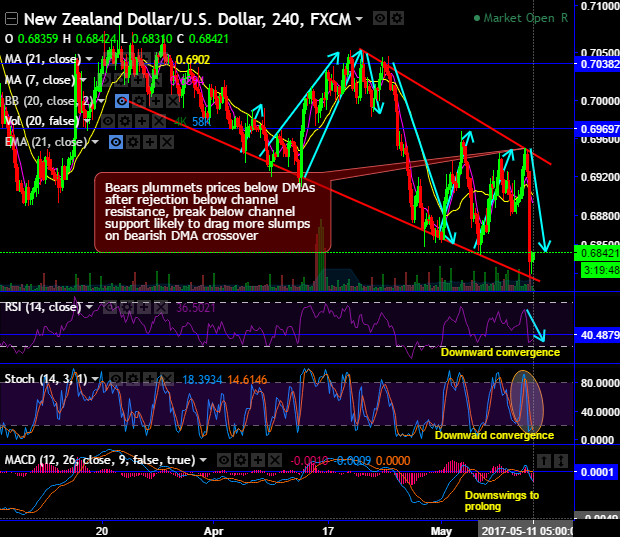

The price behavior of this pair has been drifting between sloping channel, you could very well observe as and when the prices head towards channel resistance the prices are tumbled to channel base and bounce back again as it touches channel baseline.

Well, although there has been a mild bullish sentiment in the recent trading session after channel support, the ongoing rallies are unlikely to show stern moves above as we’ve traced out bearish DMA crossover.

Most importantly watch for the day, if there is no momentum achieved from the current levels then we foresee most likely resumption of bearish swings. Even if there are any abrupt upswings they should be restrained below 7DMAs again.

On the broader perspective, we noticed the recent upswings are restrained exactly below 7EMA, please be advised that more dips seem likely on failure swings and bearish EMA crossover on monthly terms.

Momentum study: To substantiate the bearish stance available on weekly terms, both leading indicators (RSI & stochastic curves) in conjunction with MACD evidence the bearish convergence that signals strength and momentum in selling interests.

Trade tips:

Contemplating bearish sentiment, on trading perspective, it is advisable to buy at spot ref: 1.7499 (while articulating) we advocate one touch binary puts for intraday speculators in an on-going bearish environment that are likely to fetch leveraged yields as we observe 1D IVs are spiking higher with sky rocketed pace.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks