NZDUSD medium term perspectives: The month ahead could see NZDUSD extending beyond 0.7500 (Sep high) if the US dollar continues to register disappointment in the Trump Administration’s policies. Further ahead, though, the Fed’s tightening cycle plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar, pushing NZDUSD lower to 0.7000. Granted, the NZ economy is strong and dairy prices have risen, but these forces are subservient to the US dollar’s trend.

NZDUSD long-term perspectives: Slide up to 0.68 levels cannot be disregarded. The US dollar has had a remarkable bounce since the US polls and has potential to rise further in the months to come. The Fed’s assertive tightening projections plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar. Against that, the NZ economy is strong and dairy prices have risen, but these forces are subservient to the US dollar’s trend.

We expect NZD to fall through this year, reaching 0.62 at year-end. The support to growth from migration will fade, while the RBNZ at the least are likely to hold rates steady as inflation normalizes, pushing real rates materially lower we think.

The economy is also now subject to credit tightening through numerous channels: macro-prudential constraints, widening mortgage rate spreads, and banks’ discretionary tightening of credit criteria to businesses. This creates the space or the need for the OCR to fall and drag NZD with it, while preserving monetary conditions.

OTC outlook and hedging framework:

Although the Kiwi dollar surged a bit in the recent times but sensing more bearish pressures in the upcoming future especially after data showed that China’s imports dropped far more than expected last month and although short-term dollar stress is seen FX markets, the greenback remained supported by Hawkish US central bank’s tone.

The FOMC remained on hold, as expected, at 0.50%-0.75%. There was little fresh news in the statement - risks are still seen "roughly balanced", activity is expected to expand at a "moderate pace" and that warrants "only gradual increases" in rates. The Fed conceded that the sentiment surveys have firmed: "Measures of consumer and business sentiment have improved of late" and their confidence on inflation has firmed a touch, the Fed noting: "inflation will rise to 2 pct" (vs "Inflation is expected to rise to 2 pct" previously). Otherwise, current conditions are largely unchanged, job gains are still considered "solid" and activity is growing at a "moderate pace". There are no strong clues here that the Fed is agitating to hike in March.

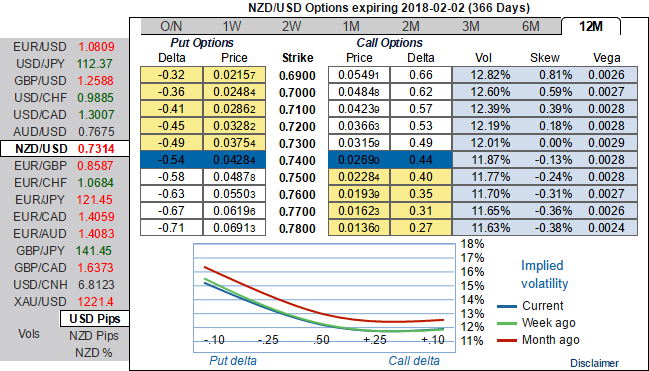

You could notice OTC market discounting these factors in 1y IV skews (they bid for OTM put strikes).

Well, to mitigate the further bearish risks, at spot reference 0.7287 we reckon the NZDUSD options strips with narrowed strikes.

Hence, we advocate to initiate longs in 2 lots of 1y -0.49 delta put options, while buying 1 lot of +0.51 delta calls of similar expiry.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices