In a context of low yields, depressed volatility and range-bound markets, writing options provide an appealing alternative to the FX carry trades but theta monitoring is what makes wise in winning such trades.

The current global macro environment is characterized by weak economic volatility. One of the consequences is that FX volatility has been depressed during most of 2H'17. Sustained growth but still-soft inflation dynamics are ensuring that monetary policy normalization is a slow process so far, with limited risk of acceleration by central banks.

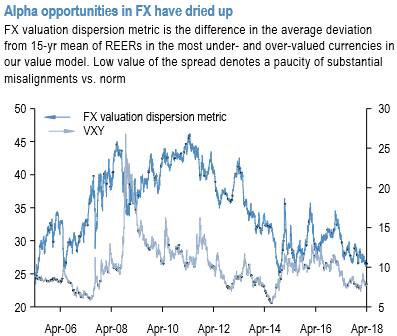

Under such a circumstance, a lack of alpha opportunities overall within FX universe away from the broad dollar trend is also being blamed for a lack of leveraged investor enthusiasm for options. There is some merit to this argument in that substantial currency misalignment that had provided fodder for major macro trades earlier in the decade have shrunk to multi-year lows (refer above chart).

While that fact is undisputable on its own, it is still unsatisfactory as an explanation for the vol softness in recent weeks since the process of diminution of value opportunities has been in train for months if not years and FX vol itself does not seem to bear much of a correlation to the metric.

In short, per our stance, the market participants are perplexed about exhausted FX vols as we are and that most of what is passing for explanations are little more than post-facto rationalizations of price action.

Market strategy amid this uncertainty is respectful of the need for theta control in this climate via a mix of carry trades in good quality EUR/EM crosses where carry/vol ratios are elevated (EURRUB) and RVs designed to earn hedged vol carry (EURCAD vs EURRUB, short NZD vs JPY correlation via vanilla triangles). Defensive trades held in the form of cross-yen vs. USD-vol spreads (GBPJPY –USDJPY, BRLJPY – USDBRL) have held in well so far, but standalone long forward vol lookalikes in EURGBP and USDCLP are proving challenging.

Portfolio changes this week involve taking profits on a long-held EURCNH carry position in light of the escalation in trade war rhetoric and adding a short 2M EURGBP – EURAUD correlation swap. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data