Euro holding stronger against Norwegian krone from the slumps as the ECB likely to deliver dovish policy outcomes, we expect both a 20bp cut in its deposit rate and a €20bn expansion of its monthly asset purchases.

On the flip side, Norwegian inflation is increased again, on a monthly basis, consumer prices rose by 0.5% in February over the previous month, as cost of food went up 3.4%. it remained the highest inflation since August 2013.

So, with the market still pricing less than a 50% chance of a 25bps cut in next week's Norges bank's monetary policy, as a result we see scope for a squeeze higher in EURNOK given our base case of a rate cut.

The central bank of Norway kept its policy rate steady at 0.75 percent for the second straight meeting on December 17th, 2015, while markets were expecting a 25 bps cut.

Policymakers consider the expansionary monetary policy is supporting the economy while the krone has depreciated and inflation has picked up, but a cautious approach to interest rate setting is needed to avoid a more rapid rise in real estate prices and debt.

However, the central bank said that if economic developments are broadly in line with projections, the key policy rate may be reduced in the first half of 2016.

The drivers of monetary policy:

Although crude is making an attempt of recovery, the oil price is still lower (below $40 mark) and will stay lower for longer. This means stronger cost cuts in oil related industries and lower oil investment. Add to this that the 2016 oil investment survey pointed to a strong drop in oil investment this year.

The Norwegian economy stagnated through the second part of 2015. The slowdown is, no surprise, to large degree oil related. But, there were some other signs of weakness such as a sharp drop in investment among the mainland firms.

Hence, any rate cut is probably needed to prevent NOK strengthening too much. While this risk overhangs, we maintain EUR/NOK projection to retest the recent highs around 9.55-60 by this quarter end (currently we aren't far away from this target).

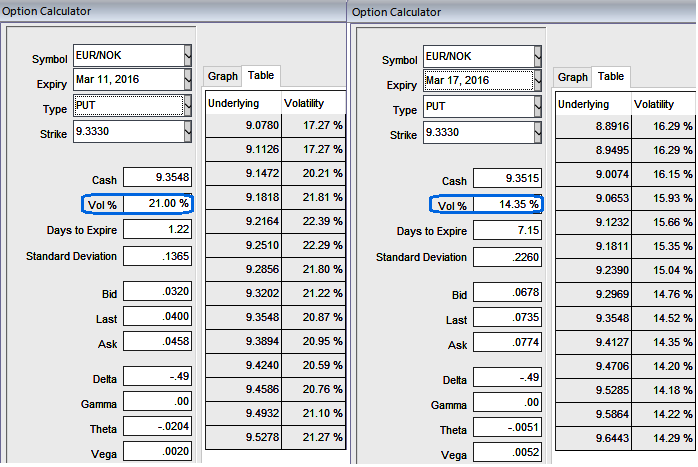

You can observe ATM calls of EURNOK is spiking above 21%, the higher IV tends to make OTM options more attractive since it means the option is more likely to expire ITM. Consequently, when IV is higher, the Vega, in general, is also higher.

FxWirePro: Norwegian CPI prints in positive again, EUR/NOK IVs extending above 20% ahead of ECB and Norges bank's monetary policy

Thursday, March 10, 2016 10:33 AM UTC

Editor's Picks

- Market Data

Most Popular

9

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings