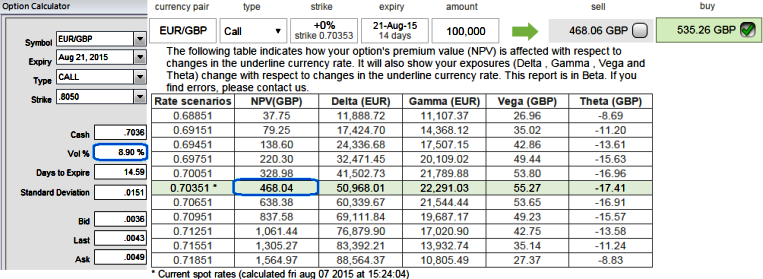

The near month volatility of ATM contracts of this the pair is at 9.15.

Vols of 14D at the money calls - 8.90%

NPV of this call - 468.04 while Premiums trading above 14.36% at GBP 535.26 for lot size 100,000 units.

Hence, comparing this call premium with volatility we think the hedging cost would not be economical as result of deploying ATM instruments.

But we cannot afford to get stuck in this riddle without hedging, so what's the alternative, here comes the strategy arbitrage strategy in which options trading that can be performed for a riskless profit as EURGBP ATM call options are overpriced relative to the underlying exchange rate of EURGBP.

To perform this conversion, the hedger holds the underlying spot FX and offset it with an equivalent synthetic short spot FX (long put + short call) position. Profit is locked in immediately when the conversion is done, the profit would be strike price of call/put - purchase price of underlying + call premium - put premium.

FxWirePro: Option arbitrage for EUR/GBP as NPV of ATM calls indicates overpriced premiums

Friday, August 7, 2015 11:15 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate