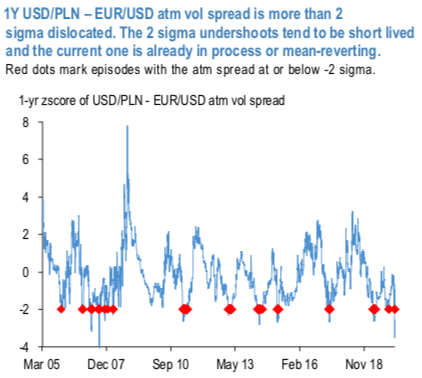

EURUSD vols have been a notable casualty of the recent market gyrations resulting in USDPLN – EURUSD ATM vol spread at 2-sigma low (basis 1-yr lookback window), a defensive dislocation worth fading, given the attractive risk/reward for buying a higher beta vol at a tight premium. Historically, such undershoots tend to be short lived, although catching the right timing can prove challenging (refer 1st chart).

2nd chart beta-to vol analysis indicates PLN to be a strong buy which in conjunction with the USDPLN - EURUSD vol backdrop allows for entering a defensive long high beta / short low beta vol spread that should hold well, given the favorable entry level.

We back-test a simple trade timing strategy of initiating long USD/PLN vs. short EURUSD at times when their vol spread drops below -2 sigma on 1-yr z- score. The red dots in 1st chart mark the entry points. The analysis shows the bulk of P/L coming within first two weeks and peaking around the 1-month mark with the distribution of the historical returns displaying favorably fat right tails, in line with the long high beta / short low beta characteristic of the vol spread.

Fading the current 2 sigma dislocation, should have potential of producing 1.5-2 vol of P/L. The real nugget is in the fat right tail characteristic that historically tend to align particularly well with the late cycle dynamics. If late cycle is to take hold more forcefully, the vol spread could realize 4-5vol of P/L. Front tenors are the preferable expression but the current liquidity conditions force tenor extension: Long 1Y USDPLN delta-hedged straddle @9.55/10.75 vs short EURUSD delta-hedged straddle @8.35/9.05, in equal vega notionals. Courtesy: JPM

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One