We’ve already raised a cause of concern on AUDUSD’s sustenance of rallies (refer below weblink for more readings on AUDUSD technical), consequently, the bears of this pair have resumed ahead of RBA’s monetary policy where cash rates would be decided in this week.

The Aussie dollar should hold around current levels near-term, before declining towards USD 0.75.

On the contrary, we recently upgraded AUDUSD forecasts also, to reflect a view that USD weakness was likely to persist for longer than we envisaged.

Our new forecast track expects AUDUSD to hold around the USD 0.78-80c level in 1H’18, after declining towards USD 0.75c.

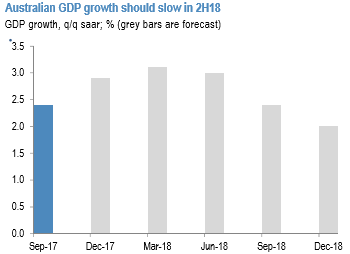

We expect both monetary policy divergence and modestly weaker commodity prices to push the currency lower. We are also expecting the pace of domestic growth momentum to decline in 2H’18, after a boost from net exports in the first half of the year (refer above chart).

OTC outlook and hedging perspectives:

While using rising IVs of longer tenors coupled with the positive shifts adding to risk reversal numbers, while positively skewed IVs on OTM put strikes could be interpreted as an opportunity to deploy longs in OTM puts with theta shorts in ITM put on time decay advantage as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

The positive shift in RRs with positively skewed IVs on OTM puts appears to be slightly puzzling, Isn’t this?

On the flips side of RBA, without disregarding the Fed’s further rate hiking cycle in 2018, the bearish stance of the pair has been substantiated by technical indications (as stated in our recent post, refer our technical section) and positively skewed IVs of 3m tenors which is an opportunity for put longs in long-term as the US central bank likely to continue hiking phase.

On hedging grounds, the foreign traders who have AUD payable exposure, shorting futures contracts of mid-month tenors are recommended as the underlying spot FX likely to target southwards 0.75 levels in the near-run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index has turned into -44 (which is still bearish), while hourly USD spot index was at shy above 90 (bullish) while articulating (at 07:33 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential