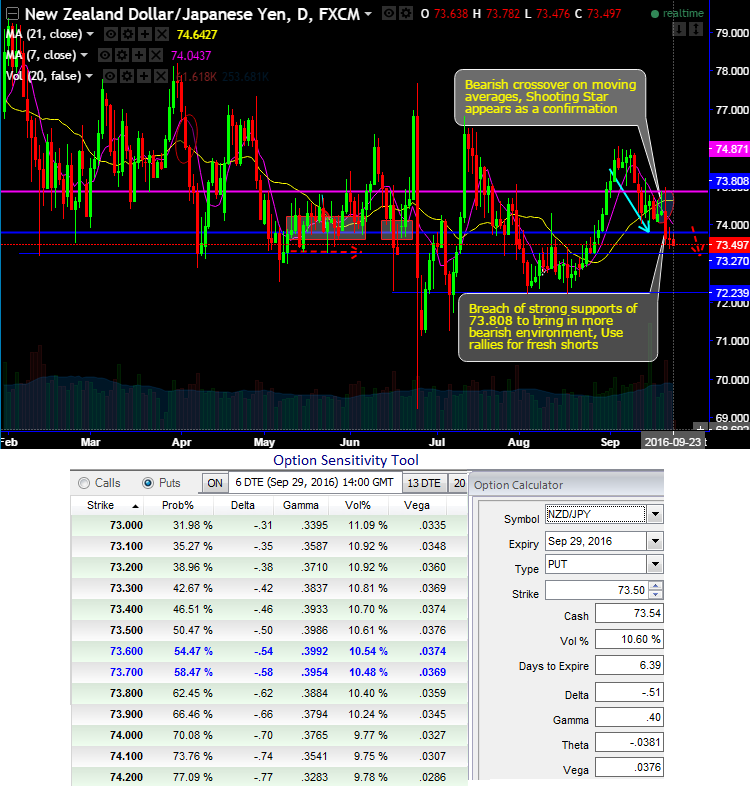

Dear readers, we had explicitly specified in our previous post to expect more dips up to the next support only at 73.272 levels and upon breach this level, bears may even drag up to 72.239 levels again, and it seems like heading towards that direction southwards.

Well when it comes to the RBNZ and RBA, the answer is probably not a great deal. The former is taking policy lower, but in a measured fashion, while the latter appears relatively comfortable with its policy settings as they currently stand. Comments from both were more or less consistent with market pricing.

Yesterday, RBNZ stays pat in its monetary policy, leaving the OCR unchanged at 2.00%, which is in-line with the market expectations. The statement acknowledged the economic developments since August and the NZ dollar has risen more than expected. After the central bank’s Market pricing for a November OCR cut has risen to around a 70% chance.

Hedging Framework:

The IVs of NZD crosses are extremely volatile even after RBNZ’s monetary policy, especially the current IVs of 1W NZDJPY ATM contracts are trading at 10.60% and likely to perceive on an average of 10.5% across all OTM put strikes that would divulge pair’s weakness (see 1W-1Y ATM IVs). While vega on the OTM put strikes are comparatively higher that signifies the sensitivity of an option’s value to a change in volatility.

So, buy 2W ATM vega put and (-0.5%) out of the money vega put option of the same expiry and simultaneously short 1W (1%) in the money call option.

In this instance, let’s visualize in 1weeks’ time NZDJPY keeps drifting southwards from current levels of 72.239 or stay stagnant or even spikes but certainly not above (1%) within 1 week, then ITM shorts would expire worthless and likely to fetch you the certain yields.

But, remember to have the reasonable Vega of a long put option position, because these HY IVs will have the predominant role in option premiums if it increases or decreases by 1%, the option’s premium will proportionately increase or decrease by respective vega values.

Here, by employing 1W ITM call writing in our strategy is an extra advantage in hedging cost and to match both higher implied volatilities and delta risk reversals.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell