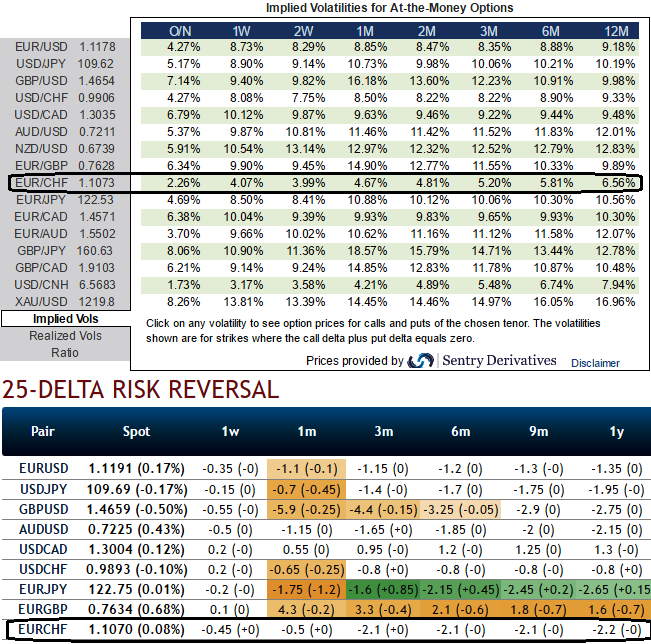

From the nutshell, one can understand that 25-delta risk of reversal of EURCHF has been one of the expensive pairs to be hedged for downside risks in long run as it indicates puts have been relatively costlier. It shows the 3rd highest negative values among G10 segment which indicates downside risks of spot FX is anticipated and hedging for such risks is relatively more expensive.

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on long term downtrend.

But, lower IVs of ATM contracts have been favourable for option writers and if you any disparity between option premiums then that should turn into a cause of concern as to whether spot FX would move in sync with risk reversals or not.

The current IVs of this pair is at 2.26%, and 4.67% for 1m tenors.

Usually, lower IV pair like this would certainly offer best writing opportunities in overpriced options.

As a result of writing options we could utilize this profitability to reduce in cost of owning spot outrights, so keeping shorting oriented option strategies in mind one can think of certain yields through Ratio Call Write as upside potential is constrained by risk reversals indications.

Hence, this strategy owns a holding of the underlying spot FX and sells more calls than shares owned. It is a limited profit, unlimited risk options trading strategy that is taken when the options trader thinks that the underlying stock price will experience little volatility in the near term.

A 2:1 call ratio write can be implemented by selling double the number of at the money calls for every number of spot FX units.

The main advantage for the ratio call write is when the underlying spot FX at expiration is at the strike price of the options sold.

At this price, both the written calls expire worthless while the value of the long spot position remains unchanged. As such, the options trader gets to keep all of the premiums received when putting on the trade in spot. Thus, maximum profit is equal to the premiums received from the sale of call options.

So, to achieve this, the calls writing should have positive theta values as it is usually expressed as the change in option's value per one day’s passage of time.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise