Bearish EURUSD scenarios:

1) Growth fails to rebound above 2%;

2) EUR appreciation and/or sluggish core CPI delays ECB policy normalization

3) Eventual repatriation by US corporates.

Bullish EURUSD scenarios:

1) The growth rebounds to 3% by mid-2018;

2) ECB becomes more comfortable with progress on wages and core inflation

The USD weakness at the start of the year to be unjustified. As a result, our EURUSD outlook is therefore based on the expectation that fundamental factors such as US monetary policy will resume control in the exchange rates in the end and that as a consequence EURUSD would ease. This correction did now start last week – caused by a renewed rapid rise in US yields – and we expect that it will continue further.

What is interesting here is that the downtrend in EURUSD would have been even more pronounced over the past few weeks if the euro had not appreciated at the same time. Our currency index illustrates that the single currency has been continuously on the up since last spring.

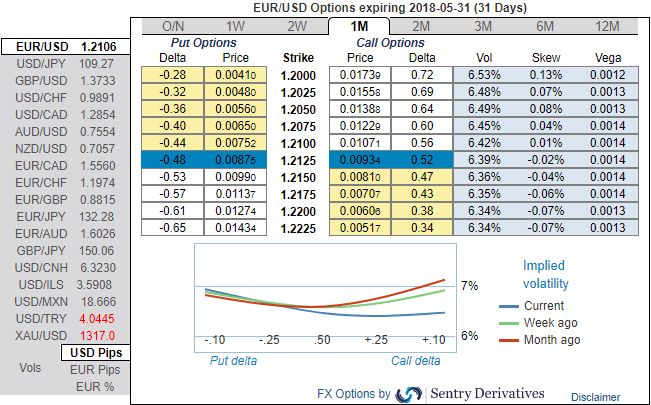

Contemplating above-stated driving forces and OTC indications as shown below, we had advocated options straddle strategy accordingly about two weeks ago on hedging grounds. We now wish them to be reshuffled into strips strategy which contains 3 legs.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bearish technical environment in the recent past and ATM implied volatilities of 1m expiries are below 7% which is on the lower side among G7 currency bloc, likely bounce back.

Most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish neutral risk reversal numbers.

The execution:

Go long in 2 lots of EURUSD at the money -0.49 delta put options of 1M tenors, go long 1M at the money +0.51 delta call option simultaneously.

Margin requirement: No.

Description: Trade the expectation of increased volatility without taking a view on any particular direction. A strategy usually utilized over significant economic data events and other political events.

Effect of Volatility: Directly proportionate to the volatility, the value of both options premiums would likely to enhance as volatility increases (good) and will decrease as volatility falls (bad).

Please be noted that the strategy likely to fetch positive cashflows regardless of the swings with more potential on the downside. Hence, one can deploy this options strategy on hedging as well as speculative grounds.

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above -59 levels (which is bearish). While hourly USD spot index was inching towards 162 (bullish) while articulating (at 09:47 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures