The news of Iranian missile attacks on two US airbases in Iraq caused a sell-off in Asian equities and a rally in safe-haven assets such as government bonds. The Brent crude oil price initially spiked sharply to almost $72bbl but later fell back after Iranian sources said that the country was not looking for war with the US.

Meanwhile, a Boeing 737 bound for Ukraine crashed just after taking off from Iran. However, it has been described as a technical accident, unrelated to the rise in Middle East tensions. In Germany, November factory orders posted a much larger-than-expected decline of 1.3% suggesting that manufacturing’s malaise continues.

US airstrike on Iraq/Iran provocation (unexpected, positive for oil complex, small negative for cyclicals). It’s always debatable whether Gulf politics is any more or less stable in a given year given that intra-regional conflict and US intervention have comingled for decades.

The ‘risk off’ reaction to the latest Middle East news has been relatively muted as markets continue to assume that the situation will not seriously escalate. So although government bonds and other safe-haven assets have rallied, most foreign exchange rates are little changed from yesterday. Energy commodities have taken aback, with WTI crude fell 1.09% to trade at $62.10 and Brent dropped by 0.60% trading at $.67.84 levels a barel.

What does change annually is the oil price’s sensitivity to shocks, depending on whether balances are tight or loose when the flashpoint is triggered and whether investor positioning is long or short of crude. The tighter the market and the shorter the positioning, the greater the scope for large and persistent price gains.

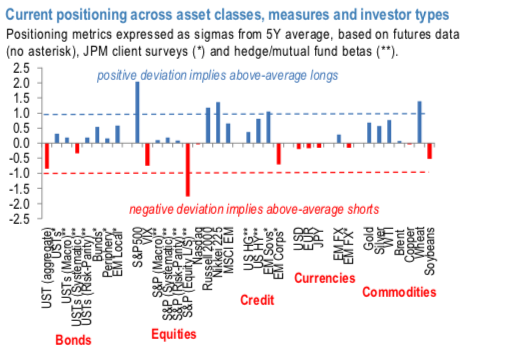

As discussed earlier, positioning has already reversed from short in Q3 (around the time of the drone attack on Saudi facilities) to reasonably long, though more so in WTI than in Brent futures (refer above chart). But the market balance has tightened to a slight deficit (perhaps 200kbd on a 12-mo moving average basis) given OPEC+ over- compliance with supply cuts, which was then formalized through Q1’2020 at the December producers’ summit.

A report by OPEC also indicated that production outside of the cartel may decline in 2020, particularly within the US shale basins, which added further bullishness to the energy commodity market. Hence, we advocated derivatives trades on crude oil, we wish to continue them on hedging grounds.

The strategy reads this way: Maintain longs in CME WTI futures of January’2020 month deliveries. Courtesy: JPM & Commerzbank

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data