The Bank of England has left its monetary policy unchanged today (bank rate at 0.75%). Even though the rate of inflation eased slightly in November rising wages suggest that underlying inflation pressure is increasing. However, whether this is also going to result in higher inflation levels depends mainly on the environment the British economy is going to be acting in over the coming months - i.e.: will Brexit happen on 29thMarch and if not, what happens next? These are the all decisive questions for Sterling, too. In view of the dominant Brexit uncertainty, monetary policy, which is aimed at the medium-term view, is paralysed and is not going to act as a driver for GBP exchange rates for now.

We analyse what the FX options market is pricing on the British pound over the next few months and propose a short update of a note focused on GBP vols.

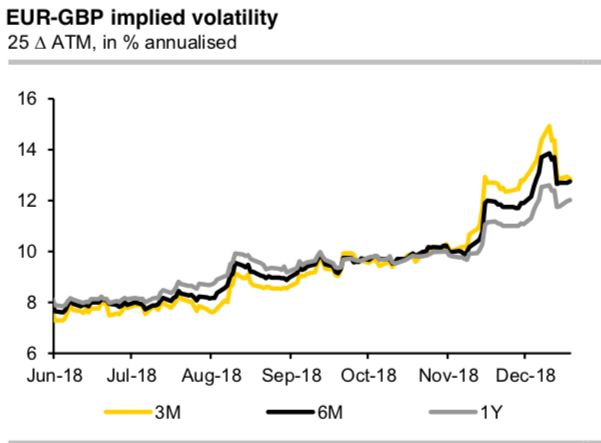

The recent fall in GBP volatilities on the options markets (refer above chart) does not really make total sense to me. Has the uncertainty concerning Brexit really fallen in the eyes of the market since the vote in the House of Commons was postponed? Of course, it was clear that Prime Minister Theresa May would lose the vote on her withdrawal agreement. But if the vote had taken place the deal would have finally been off the agenda and we would have made a tiny little bit of progress.

While a more comprehensive analysis (including a couple of trade recommendations) is contained in the earlier note, and could be updated upon request, here we limit ourselves refreshing the daily breakeven levels of GBPUSD over the next two months, following Theresa May’s victory in the no confidence vote on her leadership earlier this week.

The picture has not materially changed compared to earlier this week. 19 to 20 December is the daily breakeven commanding the highest vol premium. Following the Xmas period, where markets expect little probability of a game- changing event as far as Brexit negotiations are concerned, 11 and 18 January are the two most closely watched dates from an options perspective. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at -5 levels (which is neutral), while hourly EUR spot index was at 67 (bullish), while articulating at (12:45 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal