Swiss National bank maintains status quo in its Libor rate (keeping rate on hold at -0.75%) which is widely expected. We’ve already mentioned in our recent posts that the recent developments in the Swiss franc have been less intense over the past month than in the latter part of July when the surge in EURCHF fuelled an expectation in certain quarters that the franc was on the cusp of a material downgrade against a resurgent euro.

Elsewhere, the latest policy announcement from the Bank of England’s rate-setting committee will provide the key focus very shortly. At its last meeting in August, the MPC kept interest rates unchanged at 0.25% but two members – Ian McCafferty and Michael Saunders – voted for an immediate hike in interest rates. Developments in the economic outlook since that meeting have been limited and while political uncertainty has risen, on balance, we suspect that both Saunders and McCafferty will retain their calls for an immediate policy tightening. Equally, notwithstanding the resumption of the uptrend in UK inflation, we doubt that any other member will be inclined to join this cohort in calling for a rise in interest rates, at this stage.

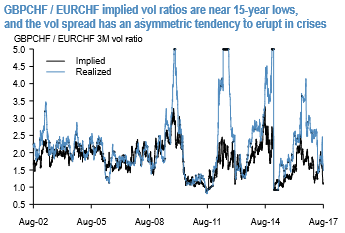

GBPCHF vs EURCHF vol ratios are approaching 15-year lows, nearly at par with extremes first witnessed at the height of the EMU crisis in the fall of 2011 that brought on the 1.20 peg in the first place, and then revisited when it was removed two years ago (refer above chart). Owning the vol spread has a desirable positive asymmetry from current levels, a tendency for one-sided eruptions in favor of a wider GBPCHF premium during market crashes, and enjoys small positive carry at inception (2M ATM vol spread 0.7 mid, 1-mo realized vol spread 1.5).

It should not escape attention too that the RV is fairly well-insulated from SNB-shenanigans: the above chart digs forensically into the return profile of vol spreads initiated every day in the months leading up to and spanning the 2015 de-peg shock, and surmises that the mean return around the episode was positive to the tune of 2 vol pts., with an appreciable positive skewness.

The results are not entirely surprising since GBPCHF’s higher risk-beta compared to EURCHF imparts an anti-risk bias to the spread that manifests in its predictable crash sensitivity in above chart, and is handy in the current context when GBP faces idiosyncratic Brexit risks and unpredictable market reaction to potential BoE rate hikes amid growth weakness. We open GBPCHF –EURCHF 2M ATM straddle spreads. Courtesy: JP Morgan

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures