The Norges Bank sounds ever more confident about economic prospects and keen to start the process of rate normalization seven years after the last hike. Just today Governor Olsen remarked on the solid prospects for investment and renewed optimism in the petroleum industry.

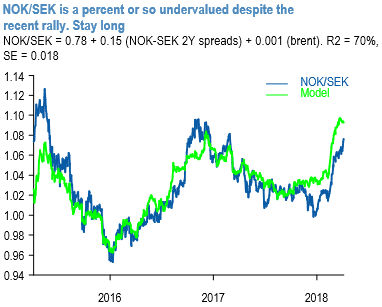

That the central bank is prepared to tighten without ever having resorted to emergency policy and with inflation running below the new lower inflation target (core is currently 1.4%) stands in stark contrast to Sweden where the central bank remains wedded to a pessimistic view of underlying inflation prospects and a neurosis about currency appreciation even though the currency is now 5% or so weaker than it projected as recently as February. The contrast in central bank attitudes leaves additional headroom for NOKSEK we believe, especially as the cross remains a percent or so below fair-value from a 3Y regression on rate spreads and oil (refer 1st chart).

In our view, the Norges Bank will start hiking in September and the pace will be in line with the roughly 50bp per annum that the Norges Bank set out in the March MPR. An August hike is a reasonable risk scenario.

By contrast, we believe that the Riksbank will hike no earlier than September and the market assumes there is a reasonable risk of the Riksbank downgrading its rate path at the April 26th MPR – Stina forwards are 15bp below the central bank’s path for 4Q’18 and25bp below the 4Q’19 level. There is some concern naturally that NOK is now a consensus and well positioned macro trade. We agree it is the consensus.

However, the Norges Bank's flow data does not yet point to an excessive accumulation of NOK exposure from foreign clients to the point where this might prevent as opposed to merely slowing further upside in NOK (refer 2nd chart). The dampening effect of the steady accumulation of foreign positions in NOK is consistent with the call spread we hold in NOKSEK (upside to 1.0920).

Trade tips: Stay long NOK via short EURNOK in the spot, long NOKSEK in options:

Short EURNOK spot at 9.4960 with the strict stop loss at 9.6675 levels.

Long a 3m NOKSEK 1.066/1.092 call spread vs short EURSEK 9.95 put for a net 20bp. Marked at 0.60%. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025