Since January, the EURUSD has essentially been driven by the S&P realized volatility, while US short rates explain it only when the influence of equity volatility is removed.

Fed's fears mean higher yields and vulnerable US equities (strong negative correlation), which implies higher S&P volatility; this, in turn, leads to a lower EURUSD.

Thus, we think that it is wise to fetch 8-9 times leveraging effects between 1.0450 and 1.0750 selling the bottom of the range.

Fundamentally, a December hike would not come as a complete surprise, so that the EURUSD is unlikely to break 1.05.

We, therefore, advocate setting a downside KO at 1.0470, just below the multi-year low at 1.0458 (16 March 2015).

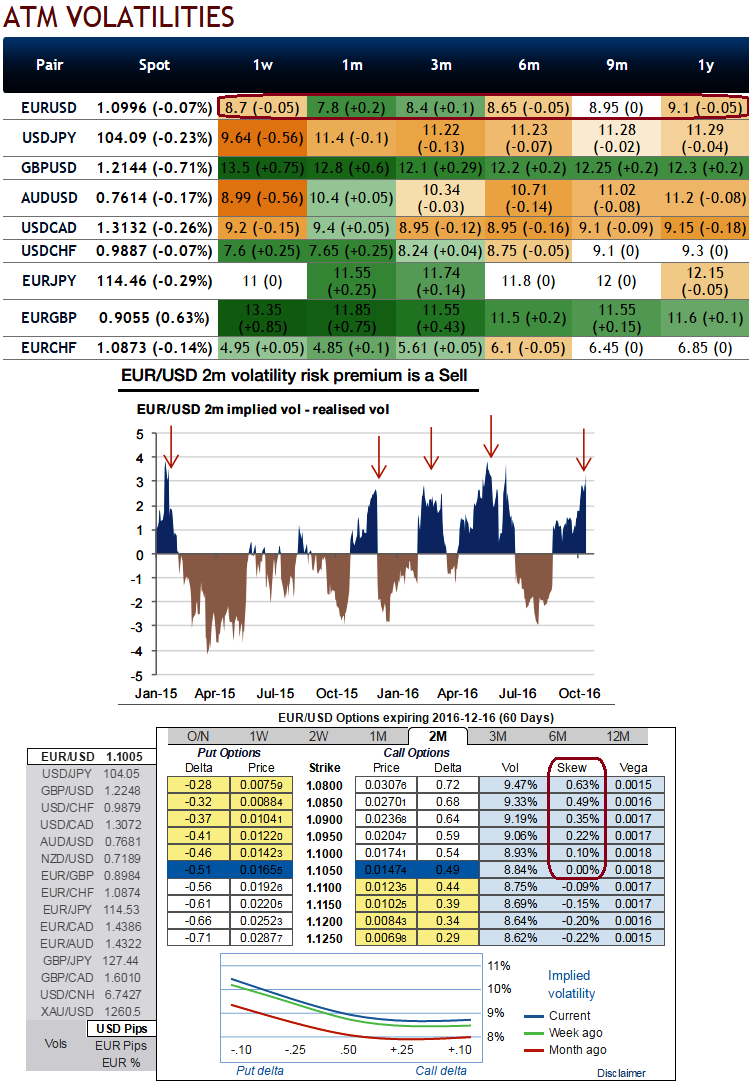

As you could observe the positive skews signify the OTC FX hedging interests towards OTM put strikes, the negative skew drives in downside volatility, so that such a barrier appealingly discounts put options.

Shorting expensive volatility is the smart option trade idea in this scenario. Instead of targeting the exact level where the EURUSD would head in next two months in a bearish scenario, we trade a sub-range, namely the portion of the full range below the 1.08 support.

A digital put is similar to a very tight put spread around the strike so that the option is short vega on the downside.

Well, the execution goes this way:

Buy EURUSD 2m digital put (European style options), strike 1.0750 KO 1.0470 with the indicative offer: 10% (vs 23% without barrier spot ref: 1.1010). The EURUSD option with 2m tenor encompasses the Fed meeting in December.

With the RKO barrier, the exotic option becomes fully short vega, no matter the spot level, which is convenient, as EURUSD 2m implied volatility is trading significantly above the 2m realized volatility.

The risk is limited to the extent of premium, the investors buying a digital put with a knockout cannot lose more than the premium paid in the event of EURUSD touching 1.0470 on expiration (i.e. at any time within the next two months), or trading above 1.0750 in exactly two months.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different