The euro was little changed yesterday, despite the hawkish Fed rhetoric, after stronger-than-expected October PMI data and comments from ECB Governing Council member Hansson that all aspects of the QE programme needed thorough discussion. Today’s speech from ECB President Draghi will be watched for further clues on whether the QE programme will be extended past March 2016.

After the initial plunge after the referendum, EURUSD has traded sideways in a relatively wide interval between 1.095 and 1.115. - FOMC sidelined for now. Data has picked up, and labor market more solid than May-numbers suggested. Brexit risks loom, although less imminent. However, the July statement gave no indication of a September hike, disappointing markets, which currently price a 50% chance for a second rate hike in September 2017.

Like Fed and ECB stood pat in July. While Draghi denied discussions of potential changes to the policy stance, but referred to the next meeting in September and the new projections published then. We expect further cut in deposit rate and an extension of QE.

EURUSD traded its tightest daily range in three weeks, consolidating above key support at 1.0800-1.0750. Further range trading is most likely, particularly as momentum studies are relatively stretched. To the topside, initial resistance lies at 1.0965/75, with a move through opening up 1.1040/50 and 1.1120. A break above these would negate the bearish sentiment and suggest a move to 1.1250-1.1400 range resistance is possible.

OTC Outlook and Hedging Strategy: (EURUSD iron Condors in jerking IVs)

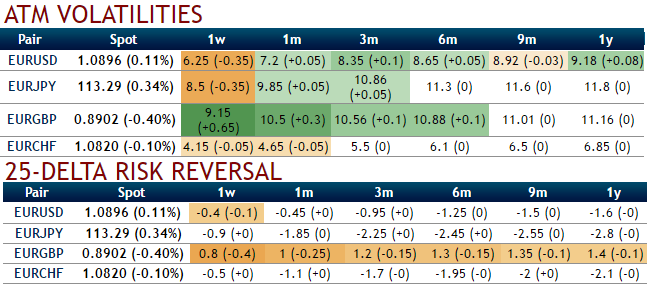

Rationale: The current IVs of 1W ATM contracts of EURUSD are crawling reluctantly at 6.25%, euro vols evidence a massive drop in recent times, as a result, the option premiums likely to shrink away on account of time decay.

The option writers are the most likely beneficiaries of the short-term volatility – Hawkish tones of Fed indicate a stronger USD. We see a next Fed hike in December and three hikes in 2017.

USD risk-reversals should be pressured further to align with the impulsive retracement in the spot.

The strategy goes this way, writing an In-The-Money call and buying deep striking in-the-money call, writing a higher strike OTM calls and buying another deep striking out-of-the-money call for a net debit, all strikes should have similar tenors.

Since the EURUSD's implied volatility is perceived to be comparatively minimal from other major G7 pairs and neutral risk reversal sentiments, accordingly we construct a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

Using options expiring on the same expiration month, the option trader creates an iron condor by selling a lower strike OTM put and buying an even lower strike out-of-the-money put, similarly shorting a higher strike OTM call and buying another even higher strike out-of-the-money call. This results in a net credit to put on the trade.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One