Both a stronger euro and a slightly weaker dollar contributed to the recovery in EUR-USD seen over the past few days. However, it seems as if the currency pair has reached its current comfort zone at levels around 1.17. Certainly, in our view, there is little to suggest that the euro appreciation will continue short term. The market is likely to have got over the shock of early elections in Italy.

For a currency in the eye of a political storm, Euro spot and vols are ending the week on a surprisingly benign note, but their nearly unchanged week-on-week levels belie the intensity of the shockwave in Italian bonds that at one point threatened to re-open the wounds of the EU debt crisis.

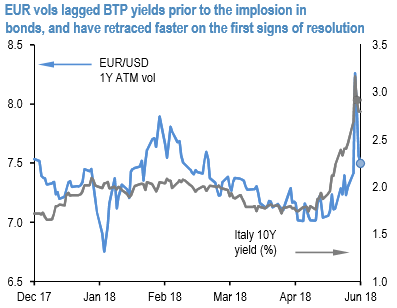

The first signs of easing in Italian political uncertainty – M5S and Lega agreed to form a government with a candidate for finance minister less Euro-skeptic than the original candidate, Paolo Savona –have seen EURUSD vols, especially in shorter-expiries, swiftly retrace nearly 100% of their gains at the time of writing following the mid-week implosion in BTPs.

Options are once again left looking too sanguine relative to the still palpable nervousness in bond yields (refer above chart) just as they were before the BTP shock, but investors have now been put on alert to the scale of the havoc that can result from more political turbulence in the days ahead.

Accordingly, long-end (1Y) risk-reversals, not just in EURUSD but also in EURCHF and EURJPY, reflect a reticence to signal the all-clear on Italian politics just yet, justifiably so in our view: unlike the enthusiastic reversal in ATM vols and short-dated skews, 1Y riskies have retraced less than 1/3rd of their intra-week widening, which also indicates the impact that flows (potentially US corporate hedging and/or European corporate hedge liquidation) are exerting in those expiries over and above the ebb and flow of political risk premium. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 65 levels (which is bullish), while hourly USD spot index was at 50 (bullish) while articulating (at 06:20 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics