Macroeconomic trends, specifically monetary policy and central bank commentary, directly impact the dollar and bond markets. Rising interest rates will rise and are a headwind for gold. The current short position in gold held by managed money traders is the smallest it has been over the last year. If any bearish catalyst prevails, adding to an already small short position could be bearish.

Given solid economic growth, a possible bottoming out in inflation and the potential further Fed repricing in 1H’18 US real rates should rise in 1Q and 2Q, thus pushing lower gold prices.

Upside risks: The growing geopolitical unrest in North Korea (such as a new missile test) could add an additional $100/oz to our forecast ($1,325/oz). We assign a 15% probability of this occurring.

Downside risks: Monetary policy tightening accelerates: more Fed hikes should in turn support the dollar and bond yields, negative factors for gold. Meanwhile, the ECB facing a stronger euro might extend its monetary stimulus earlier than expected by the market. This would mean a drop of $50/oz for the 6m price forecast. We assign a 30% probability of this occurring.

Hedging Framework:

Strategy: 1m 3-Way Diagonal Straddle versus OTM Put

Spread ratio: (Long 1: Long 1: Short 1)

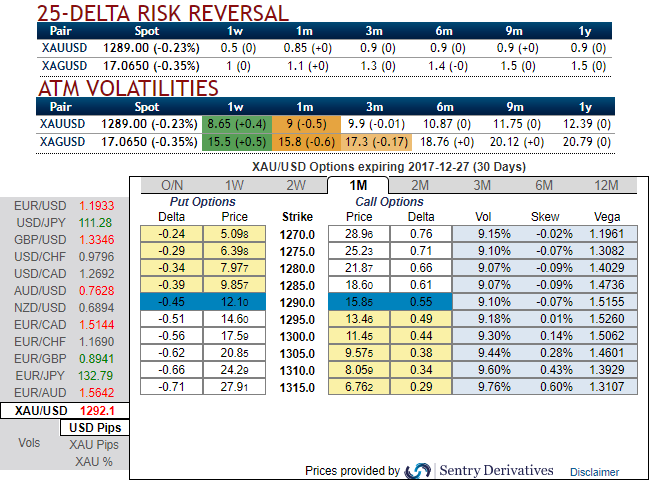

Rationale: While investors appeal for gold’s continuity to dwindle as the opportunity cost associated with rising interest rates weighs on gold prices, this’s evident in OTC markets. So, let’s glance on sensitivity tool, the bullish neutral risks reversals indicate upside risks in underlying spot gold prices, while lower implied volatilities with well-balanced positively skewed IVs signify the put writers’ advantages.

For 1m IV skews would signify the interests of OTM call strikes that means the ATM calls higher likelihood of expiring in-the-money, so writing overpriced OTM puts would be a smart move to reduce hedging cost.

The execution:

Go long in XAUUSD 1M at the money -0.49 delta put, and go long 1M at the money +0.51 delta call and simultaneously, Short 1W (1%) out of the money put. Thereby, we favor bulls as we foresee more upside risks by keeping longer tenors on call leg.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge