We could foresee euro’s bearish scenarios on following driving forces:

1) Euro area growth is stuck below 2% and ECB hikes only in 2020;

2) The prolonged political dissents and apprehensions in France, a populist tide at the European parliamentary polls in May.

3) The resumption of the EM sell-off boosts USD due to the prevalence of cross-border FX funding in USD,

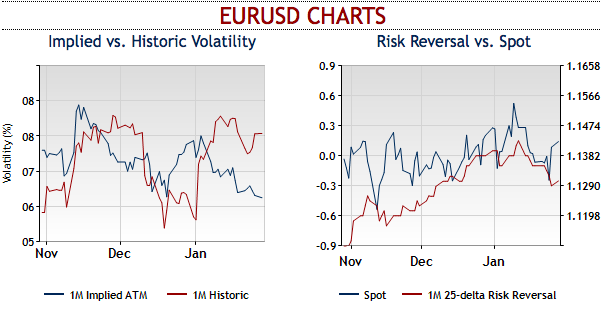

Please be noted that EURUSD shows the divergence between implied volatility (IV) and historic volatility (HV) curves. Also, be noted that spot and risk reversal curves. Volatility traders perceptibly expect only about what is likely to and what actually turns out. As you could observe the above chart, Jan’2018 seems to be an average month as the divergence between implied volatility and historic volatility. IVs have constantly been sliding, while RVs are spiking higher.

Spot curves of this pair move in tandem with risk reversal curve until of-late, now they are also showing divergence.

From this perspective, the real far-off month, when HV was actually higher than implied volatility, then the only such instance of divergence during the recent timeframe observed.

While 3m positively skewed IVs have still been signaling downside risks.

Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks.

To substantiate these indications, bearish neutral RRs across all tenors, which is in line with the above-stated bearish scenarios.

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing put holders. Contemplating all these factors, we advocate below options strategy.

Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors. Dubious bulls can also deploy 1% in the money puts with attractive delta. Thereby, in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix, Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 92 levels (which is bullish), while hourly USD spot index was at -34 (bearish) while articulating (at 12:28 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise