Away from trade clashes, crude oil is re-emerging on macro radars as a potential petro-FX catalyst. The rally in Brent to $70/bbl this week, partly on inventory data and in part due to geopolitics (Iran), did not benefit our NOK longs (short EURNOK and long NOKSEK) to the hoped-for extent amid the risk-off tone to markets, and leaves them looking cheap with room for catch-up.

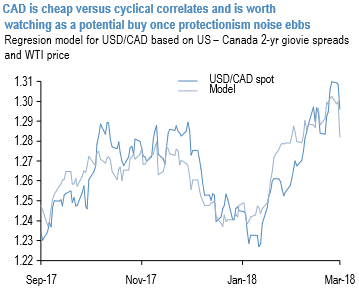

Along similar lines, CAD is on our watch list as a potential buy once decibel levels around protectionism ebb.

Press reports this week suggested a major American concession in NAFTA discussions on the US content of auto exports from Canada and Mexico, which ought to shrink part of the sizeable risk premium in the currency (refer 1st chart), while inflation now running above target in both core and headline will cap the amount of dovishness BoC will feel comfortable delivering.

Monetary policy to be more decisive than oil prices. The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices.

However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. CAD rates recently climbed above USD rates for the first time since 2014 (refer 2nd chart), and our USD rates projections can realistically drag the USDCAD to 1.20.

Bearish NOK scenarios, if:

1) Crude oil supply tracks higher than expected. Brent reverts to low $40s.

2) Economic recovery loses impetus, inflation falls further and Norges Bank reinstates an easing bias.

Bullish NOK scenarios, if:

1) Crude prices increase further

2) Growth accelerates on the lagged impact of oil recovery,

3) Norges Bank upgrades rate path further and expedites the start of the hiking cycle to 2018

Trade perspectives:

Stay long in 1M vs short 2M USDCAD call no-touch calendar @1.3150, in 0.8:1.0 ratio notionals, spot reference: 1.2826 costs 4.8%USD.

Stay tactically long spot NOKSEK and short EURNOK.

Longs in 3m NOKSEK 1.0661.092 call spread vs EURSEK 9.95 put.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms