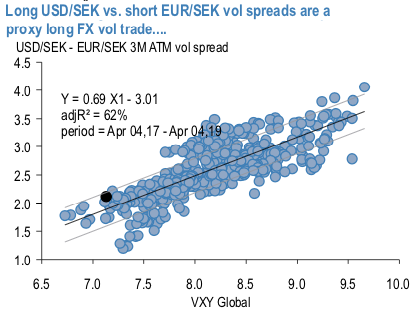

Long USDSEK vs short EURSEK vol spreads is a carry friendly way of owning FX vol from multi-year lows.

Owning USD vol over cross-vol has almost always acted as a proxy bullish vol stance owning to the greater risk beta of the USD leg, and USDSEK vs EURSEK is no exception (refer 1stchart). Case in point, the 2 vol trough-to-peak vol spike in the VXY index during the EM sell-off of Q2-Q3 last year was accompanied by a near-identical move in the USDSEK – EURSEK 3M vol switch. By construction, the spread is more or less immune to idiosyncratic SEK dynamics (if anything, a tad positively geared to krona noise owing once again to USDSEK’s greater beta).

The additional appeal is that unlike in most individual currency pairs, implied vs. realized vol technicals are favorable for sustaining the position without stopping out on the decay bill (refer 2ndchart).

Comfortingly, USDSEK also screens as a strong conviction vol buy on our machine learning-based (SVM) gamma trading model (refer 3rdchart), hence downside to vol ownership there should be limited. For those averse to any kind of vol ownership in the current climate, it may still be worth considering the short EURSEK leg of the RV above in limited risk format.

Our preference is for a 2M 10.30 – 10.65 at-expiry digital EURSEK range (seller of the range collects 44% EUR from selling a 2M 10.30 EURSEK digital put and a 2M 10.65 digital EURSEK call) that eliminates the jump risk of American barriers (DNTs) even if it comes at the cost of markedly reduced leverage (1:2.3 instead of say 5:1).

The JPM’s macro analysts foresee EURSEK nearly flat through 2Q (10.40) and only modestly lower around 10.30 in 6m time, the lack of excitement in spot probably attributable to a slow-moving Riksbank.

The range extremes in our preferred structure are skewed to the upside in the spot in deference to the deep malaise in Euro area growth that can potentially extend EURUSD weakness to or below 1.10 in coming months; such Euro weakness has historically been associated with a rise in EURSEK.

Activated USDSEK vs EURSEK vol spread as a positive vol carry RV expression via long 2M USDSEK 9.47/9.06 strikes (25D) strangle @7.75/8.4vols vs short 2M EURSEK straddle @5.65ch, pays 85bp SEK, not delta hedged; spot refs 9.283 and 10.423, respectively. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index was at 101 (highly bullish), EUR is at -48 (bearish), while articulating at (11:18 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target