Being right or wrong doesn’t matter as long as your portfolio is able to generate positive cash flows as per George Soros.

But this time the billionaire and legendary investor went wrong, whose 1992 flutter against the British currency made hedge fund history, has not repeated the history, the bet ahead of sterling’s record tumble on Friday went in vein.

Whereas, FxWirePro had consistently been anticipating and advocating hedging bearish risks of the sterling crosses.

Below are a few samples where we’ve advised to stay short in GBPUSD, the importers and exporters in the long-term who have deployed these hedging strategies, by now they would have saved in the steep tumble of GBPUSD trend.

Please follow the below link for our previous articles:

For now, although some momentary gains are expected, it wouldn’t be deemed them as long opportunities but a speculation.

We would still foresee some more weakness leftover in this pair as a result post-referendum effects, even though outcomes are out, it takes minimum 1 year to settle down the formalities before actual exit takes place.

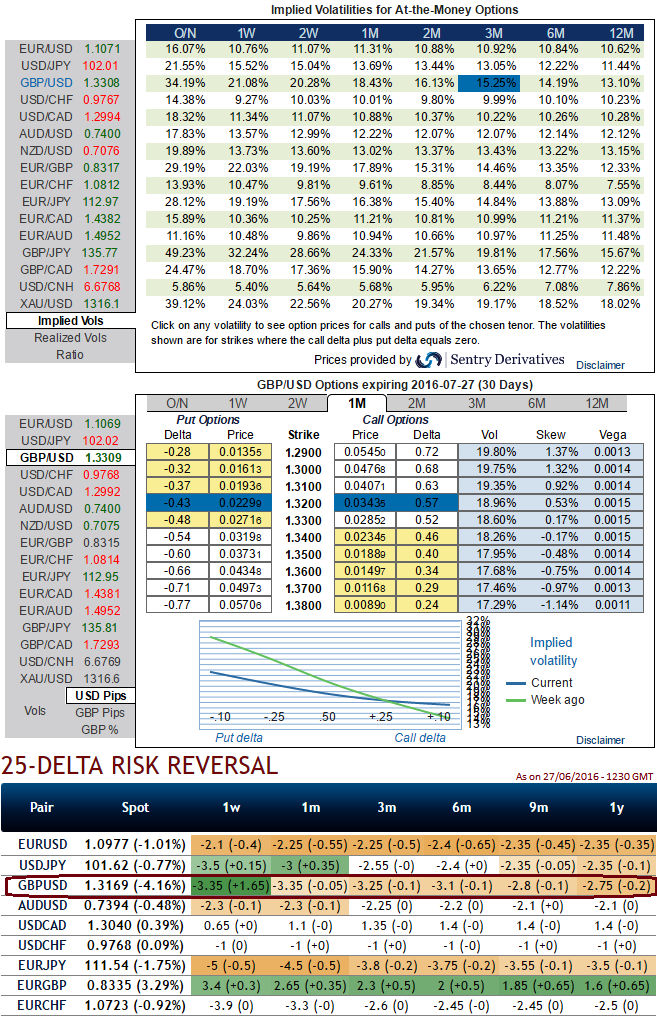

As a result, we recommend a GBP/USD 1-3M risk reversals that signify more bearish risks in this pair i/o 1Y as a generic hedge for Brexit risk and stay calm with bearish hedging vehicles as advocated before.

The ideal entry point is not ideal given the near doubling of the risk reversal since early October, but the bias is for further widening of the skew in slightly OTM strikes on persistent-bleed demand for post event protection.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts