Sterling appears to be untradeable and remains in the firm grip of the ongoing Brexit drama, but the British currency seems to have discounted most of the bad news on current levels.

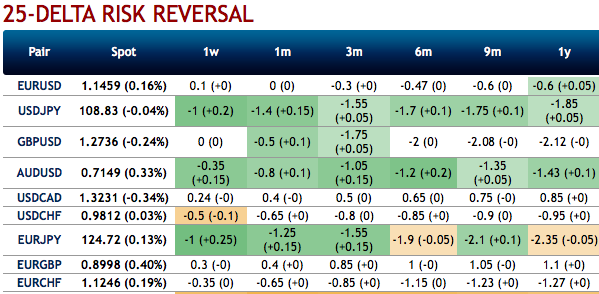

We have seen fresh positive shift in GBPUSD negative risk reversals, but IV skews have still been indicating bearish risks. Hence, mild rallies may be expected despite broad based bearish outlook.

We positioned for a modest but with a pinch of salt albeit distinctly bounded relief rally in GBP through a ratio put spread.

We hold a legacy put in EURGBP but without any visibility or insight as to how the political logjam over Brexit will be cleared.

Yesterday’s vote in the House of Commons, that now makes it more difficult to (financially) prepare for a disorderly Brexit, illustrates: an increasing number of MPs, also from amongst the Conservatives, are no longer willing to be impressed by the Prime Minister’s threat of a no deal – they simply do not want it.

The debate on the EU withdrawal agreement in the House of Commons today will be kicked-off by Brexit Secretary Stephen Barclay. The “meaningful vote” is now confirmed as next Tuesday evening (15th January).

According to reports, the UK government is continuing to seek new assurances from the EU on the Irish backstop, while also denying it is seeking an extension of Article 50 (to delay Brexit) if the deal is voted down next week.

Last night, the government was defeated on amendments to the Finance Bill, which may suggest that a ‘no deal’ Brexit will be more difficult to implement.

A positive vote about the exit agreement with the EU next week has nonetheless not become any more likely, instead May has merely lost scope to act. So please do not go ahead and buy Sterling hoping that a no deal Brexit has become less likely following yesterday’s vote. Beware of false hopes. Courtesy: sentrix, saxobank

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at -64 levels (which is bearish), hourly USD spot index was at -56 (bearish) while articulating at (10:11 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?