Do you think the Brexit dust has settled? Is Cable slump poised?

The unexpected announcement a few weeks back of an early general election for June 8 managed to wrong-foot pretty much all of the political pundits who had expected PM May to soldier on with her narrow parliamentary majority (mainly because that is what the PM had insisted she would do).

The announcement has been favorably received by GBP whose trade-weighted index has subsequently appreciated by a net 1.7%. As things currently stand, GBP has now retraced approximately one-third of the peak-trough decline following last year’s referendum vote.

The net depreciation attributable to Brexit is now 16%, which puts it on a par with the ERM crisis in 1992 and is only half as severe as the banking crisis of 2008-2009.

While the positive reaction of the last few weeks is understandable insofar as the early election is liable to deliver a substantively enhanced majority for the Conservative government (from 12 seats to perhaps 100) and in all likelihood opens a smoother path to Brexit, we do not believe it paves the way for a sustained recovery in GBP.

After Brexit apprehensions, GBPUSD recoupled with short-term rates, which are unlikely to trend in H1’17. The Brexit formalities would not be soft but seem unlikely to bring in large surprises or any dramatic movements in GBP over the next six months. Settling dust and the cable’s future range make GBP volatility a Sell.

Cable neither up nor down: The forecasts suggest the cable in the upcoming months to remain in its new range above 1.23, but not rise as high as 1.3033 or maximum upto 1.33. The UK outlook is definitely too gloomy to turn bullish Sterling and believe in a firm continuation of the ongoing short covering.

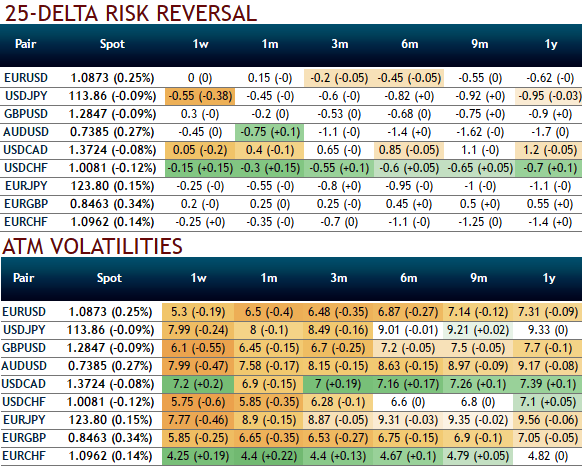

Please be noted that IV skews have been evenly distributed towards both OTM put as well as OTM call strikes for 1-3m tenors, while bearish-neutral risk reversals indicate the same, hedgers’ bet for underlying spot to remain in its new range above 1.23, but not rise as high as 1.3033 or maximum upto 1.33 while vols are shrinking away.

For more reading on GBPUSD major downtrend, please visit below weblink:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays