It is slightly difficult to understand the market reaction to the Turkish central bank’s (CBT) rate cut by a staggering 425bp yesterday: initially, the lira eased a little and then it appreciated only to then close on slightly higher levels than before the rate decision. And all that despite the fact that this step, in particular, illustrates that the CBT is likely to cut rates again over the coming months. As expected, the CBT justifies its cut from 24% to 19.75% with the allegedly improved economic outlook - amongst other the slight fall in the current account deficit - and the fall in inflation. The inflation outlook had improved, according to the CBT. It continues to refer to its monetary policy as being restrictive and supportive of a disinflation process.

We were skeptical about this argument even ahead of the rate decision: the improvement of the current account is mainly due to reduced import demand due to the recession, the fall in inflation, on the other hand, is due to base effects (the effect of the strong lira depreciation last year is no longer included in the yoy comparison); underlying inflation pressure remains in place. In view of the weak economy, it is understandable that both the government and the new governor of the central bank would like to see lower interest rates.

However, the risk is considered as rate cuts, either yesterday’s or possibly future ones might have a horrible boomerang effect. That would be the case if inflation rates start rising again by year-end as we expect so that real interest rates will slip into negative territory once again, causing the lira to depreciate, which will fuel inflation further. That is why the market reaction is incomprehensible, as yesterday’s step constituted the foundation for future lira weakness.

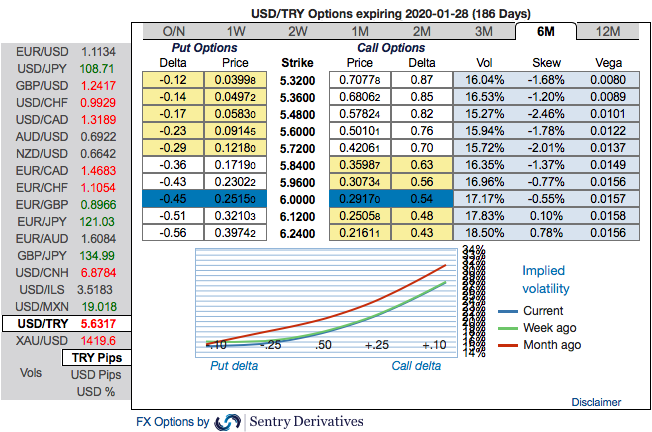

Trade tips:Capitalising prevailing price dips, we reckon that it is the ideal time for deploying longs with a better entry level, on hedging grounds 3m USDTRY debit call spreads are advocated with a view to arresting upside risks. Initiated 3m 5.50/6.24 call spreads at net debit. Thereby, one achieves hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

The rationale for the trading: Please observe that the above technical chart is also clearly indicating the further upside risks.

It seems that hedgers of TRY are positioned for the upside risks on the above fundamental factors. The positively skewed IVs of 6m tenors are bidding for OTM calls strikes up to 6.24 levels.

IVs of this underlying pair is also on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is conducive for the option holder, just for an intuition that the higher likelihood of the market ‘swinging’ in holder’s favor. Please also be noted short-dated options are less sensitive to IV, while long-dated is more sensitive. Courtesy: Sentry & Commerzbank

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data