Sell a put against existing cash short in EURSEK. Stay short NZDSEK in options The structural case for SEK appreciation remains intact the real effective exchange rate is 10-11% below its long term average despite an economy that has a positive output gap and which continues to deliver above-trend growth. This week it was reported that Q4’16 GDP jumped by 4.2%.

In addition we upgraded our forecast for Q1’17 from 3.0% to 4.0% (the Riksbank expects 3.2%). The problem for SEK is not the economy but rather monetary policy which is still myopically fixated on delivering at-target core inflation.

A central plank of the central bank’s strategy is too impede a fundamentally justified appreciation in SEK for as long as it can, which is why we expect only a relatively slow pace of SEK appreciation. In order to better reflect the outlook for a slow grind higher in SEK we are converting our cash short in EURSEK into a covered put.

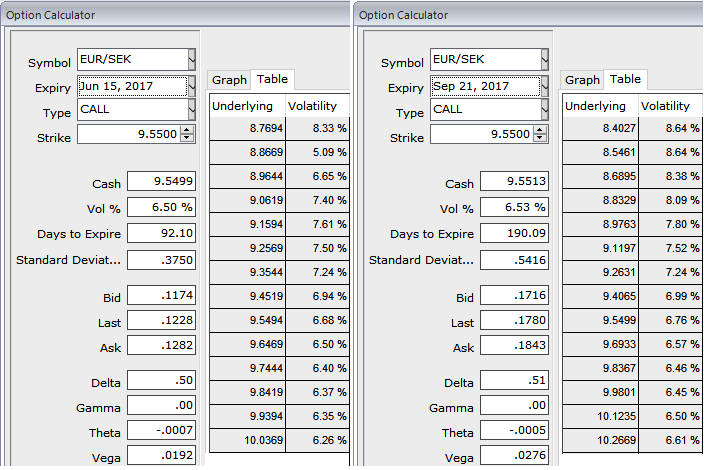

This serves to improve our entry level by around 0.5% and provides some positive time decay as SEK is prone to consolidate in the four weeks between the only data point that matters for Riksbank, CPI. EURSEK vols like all euro pairs are elevated as result of the French election premium so there’s added value in selling lower-strikes in EURSEK at this juncture. 3-mo implied vol of 6.65% compares to realized vol of only 4.9%.

Sell a 3-mo EURSEK put, strike 9.35. Receive 0.52%. Spot reference 9.5533.

Sold EURSEK at 9.4847 on January 13. Stop at 9.6850. Marked at -0.54%.

Bought a 6-mo NZD put/SEK call, strike 6.10 for 1.47%. Spot reference 6.2372. Marked at 0.42%.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom