The break of 8.0 on USDJPY 1Y ATM vol back in December had caused a frisson of excitement among vol accounts looking to buy Yen vega as a strategic late cycle FX vol play, but what was deemed to be a key technical support level has long since been left in the dust. 7.0 now looms as the next major target, beyond which there is still substantial room to fall to revisit pre-GFC levels in the 6s. It is difficult to argue with option prices steadily softening when the spot is stuck in a tight 109-111 range and delivering 2-2.5 pts. below implieds. There is also a case to be made that the ongoing softness in realized vols can continue longer than some anticipate, since the propensity of the Yen to rally in market downturns is being dampened by a cyclically wide US-Japan interest rate differential that is fuelling above-average equity and FDI outflows, alongside a reduction in FX hedge ratios of traditionally well-hedged foreign bond purchases.

As is almost always the case around this time of the year, such realized vol drags are being exacerbated by drip supply of vega from Japanese importers who are beginning to add to USD-buying FX hedges with embedded short optionality on downticks in USDJPY spot.

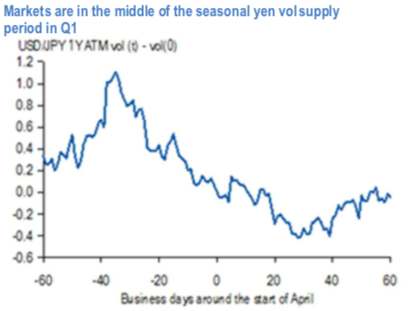

Over the past few years, much of this flow has been well-known to be concentrated in and around the Japanese fiscal new year at the end of March, which imparts a distinct bearish seasonality to the behavior of yen vol in Q1 and early Q2 (refer 1stchart). The magnitude of this seasonal decline is substantial: the average peak-to-trough dip of 1.4 % pts. over a 3-month period centered around March 31stsuggested as shown in 2ndchart that is in excess of 1-sigma of quarterly variability of Yen vol over the past decade. Anecdotal accounts suggest that transactions in such hedges are also turning increasingly tactical i.e. spot USDJPY level dependent, with the result that corporate vega supply, even if in smaller clips outside of the peak months, is becoming something of a persistent feature of the market. While difficult to quantitatively compare with the 2006/07 period in the absence of publicly available transaction data, this corporate flow bears shades of the well-known Uridashi-driven vol supply of the pre-GFC years that had pressured USDJPY 1Y vol to all-time lows in the mid-6s by late 2006.

We are also given to understand that the 2019 vintage hedges have been extremely light so far, implying that the decline in Yen vol YTD has largely been a global macro risk premium compression story with almost no idiosyncratic flow assistance from importers. This, and the fact that we are deep in the middle of the traditional FX hedging season, renders any notion of purchasing Yen vega premature. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing 0 (which is absolutely neutral), while hourly JPY spot index was at 107 (highly bullish) while articulating (at 05:30 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays