The summary of the BoE meeting in March contained three main triggers for changes to the BoE’s current monetary policy stance.

1. CPI inflation. 2. Wage growth. 3. Private consumption.

• Higher CPI inflation and/or higher wage growth than currently expected would increase the likelihood of a hike.

• Slower private consumption growth than expected would increase the likelihood of a cut.

In line with our expectations, the Bank of England (BoE) made no policy changes at its March meeting and reiterated its neutral stance by repeating it could move ‘in either direction’.

• However, there was a hawkish twist. First, Kristin Forbes (a known hawk) voted for a March hike. Note, though, that she is leaving the BoE on 30 June 2017, which makes her hawkish stance less important. Second, the statement revealed that ‘some members noted that it would take relatively little further upside news…for them to consider that a more immediate reduction in policy support might be warranted’.

• We still expect the BoE to remain on hold for the next 12 months. While we think it is unlikely the BoE will tighten monetary policy in a time of elevated political uncertainty, we think we need to see substantially slower growth and/or higher unemployment before easing becomes likely again. Also, BoE Governor Mark Carney has said that one of the reasons the UK has been resilient to Brexit uncertainties so far is due to the significant monetary easing from the BoE.

• Note that the BoE reaction function has changed since the financial crisis: BoE puts more weight on growth/unemployment relative to inflation.

In our view, the BoE seems to be more worried about slower growth than too-high inflation if this is only temporary.

OTC Outlook:

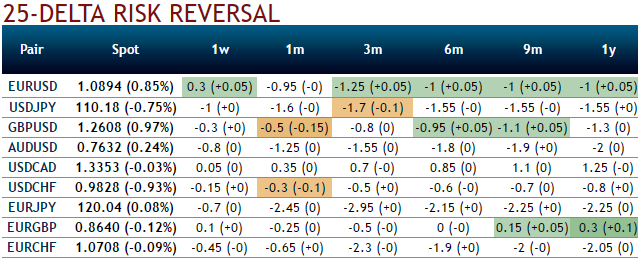

Delta risk reversals of EURGBP: As a result of that macro theme and central bank’s driving forces, from the nutshell showing delta risk reversals of EURGBP, you can probably make out that the pair has been one of the most expensive pairs to be hedged for upside risks as it indicates calls have been relatively costlier over puts but hedging sentiments for upside risks are intensified in 1 year tenor.

Needless to specify, GBP vols have still been flying high pace no matter what both prior and post-Brexit events, but this time these IVs are also owing to BOE’s monetary policy decision.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays