If 2020 is a year in which the reflation trade becomes as dominant as in 2017, NEER depreciation could be large. The decline could be even larger than in 2017, given that in that year, the JGB 10-year yield was positive, as was the carry from investing in FX-hedged 10-year US treasuries. We also note that Japan’s trade surplus was still around 1% of GDP. By contrast, Japan’s trade surplus will be essentially flat next year. Two other factors could contribute to sustained outflows, depressing the NEER:

JGB 10-year yields were still positive in 2017 and 2018, after the BoJ introduced its yield curve control policy. However, from early 2019, yields entered negative territory, and remained negative for the most part. This episode of negative rates has already outlasted that of 2016 when yields first dipped below zero; Japanese investors are finding themselves in an unprecedented period of negative yields.

Around JPY50 trillion of JGBs held by investors other than the BoJ is set to mature in 2020, against only JPY11 trillion yen of positive yielding ultra-long-term bonds.

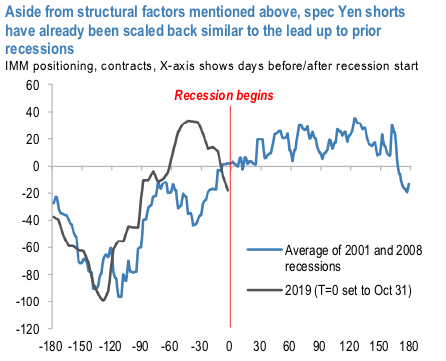

The global downturns have typically prompted JPY appreciation, current positioning suggests less favorable conditions for rapid JPY strength even if US recession fears re-intensify in 2020. While there is no denying the possibility of a global recession leading to relatively large Yen appreciation, we think rapid JPY appreciation is less likely even if concerns over a 2020 US recession intensify.

One reason for the Yen’s appreciation when entering a global recession is that investors with speculative JPY short positions face increased volatility and buy back JPY to close their short positions; we note that there was a rapid reduction in speculative Yen shorts leading into the start of the 2008-09 recession in particular, as market recession expectations were re-aligned (refer 1st exhibit).

OTC outlook: The positively skewed IVs of 3m tenors are signifying the hedging interests for the bearish risks (refer 2nd exhibit). The bids for OTM puts expect that the underlying spot FX likely to show further dips so that OTM instruments would expire in-the-money (bids up to 119.50 levels).

Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal (RR) set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term (refer 3rd exhibit). Please be noted that 3m negative RRs suggest the overall OTC hedging sentiments for the further bearish risks. Hence, we advocate below hedging strategy contemplating the current OTC indications.

Options Strategy: Contemplating above factors, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging as well as trading grounds as the mild abrupt upswings were contemplated earlier.

Short hedge: Alternatively, we advocated shorts in futures contracts of far-month tenors with a view to arresting potential dips, since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for March month deliveries. Source: Sentry, JPM & Saxobank

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data