FX streets are projecting for 215K from the ADP employment data which is a slight contraction from previous flash at 237K. We reckon that Friday's payrolls are more dependent on the employment component of the ISM-non manufacturing survey. ADP report will provide guidelines to shape sentiment about the labour market ahead of Friday's payrolls release. A reading of 56 in the employment component will be broadly consistent with the current NFP consensus of 215K, so a large deviation today should highlight the risk around weekend's payrolls. While US trade balance is projected to expand at 42.8 billion from previous flash at 41.9 billion, this increase in deficit may slightly be perceived as negative for dollar in short run otherwise the currency looks in god shape.

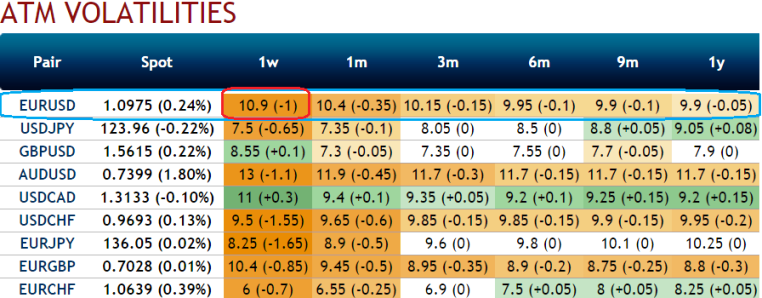

As we can make out from the volatilities of EURUSD ATM contracts, it is comparatively higher side even at 1W tenor. So option premiums on either direction would be highly volatile regardless of swings, one can get benefitted from such situations by buying one touch binary vega calls in order to extract leverage on extended profits.

Current, volatility for Euro American pair is at 11.75% which is quite higher side among major currency pool, by employing these binary vega calls one can not only multiply the returns by twice, thrice or even pour returns unimaginably but also upbeat the implied volatility. But do remember this call is strictly on speculative grounds.

But for the traders who are risk averse, the spreads using one touch EURUSD vega options are recommended which are constant time and barrier levels. Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times. We believe one touch Vega spreads can be the best suitable options to trade HY vols. The prime merits of such one touch option spreads are high yields during high volatility plays. Wider spreads indicates lack of liquidity.

FxWirePro: Trade EUR/USD vega spreads on ADP employment and US trade data

Wednesday, August 5, 2015 11:40 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?