Positive factors less likely to drive CAD than draggers:

Trump’s protectionist declarations, notably labelling NAFTA as the “worst trade deal in the history of the country”, make the Canadian dollar especially vulnerable in the weeks ahead. Clinton has been ahead in the polls most of the time, but Trump is again catching up.

Clinton’s lead is less than two points, suggesting that the election outcome is likely to be very uncertain until the vote. The threat weighing on Canada’s status as a privileged trade partner should be increasingly discounted by FX markets.

In addition to that BoC’s dovish shift biases near-term CAD weaker: The BoC September policy meeting was dovish, as the bank significantly shifted the risk profile to inflation from “roughly balanced” to now “tilted somewhat to the downside”.

The commodity-related Canadian dollar was also hit by tumbling crude price on Friday due to reports that Iran's August crude oil exports jumped 15% to a five-year high of more than 2 million barrels per day, sparking fresh concerns over a global supply glut. Supply adjustment or an OPEC deal causes crude to pierce $60/bbl earlier than expected.

USDCAD has been trading sideways in a range for months but is currently testing an important resistance area. A decisive break of the 1.32 region would open the door for fast gains.

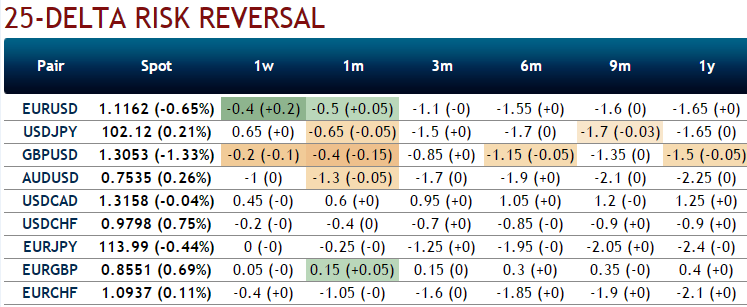

From the nutshell showing delta risk reversals of USDCAD, you can probably make out that the pair has been one of the most expensive pairs to be hedged for upside risks as it indicates calls have been relatively costlier over puts which indicate upside risks of spot FX is anticipated and hedging for such risks is relatively more expensive.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential