Gold broke above $1,400/mt on a perfect mix of ingredients – low bond yields, a soft dollar, geopolitical and trade tensions, and slowing global growth. Despite the slight sell-off in equities, safe havens sold-off as well, with gold, the yen and safe government bonds weaker. US 10-year yields rose to its highest level in a week, while the NOK strengthened as oil prices continued to inch higher.

The gold is likely to drive up to the next strong supply zone of $1,500/mt. The buying sentiment intensifying bullion market stronger, having broken the 6-year resistance level of $1,400/oz and having largely consolidated between $1,200 to $1,400 for the better part of three years.

Entire focus would now be on the G-20 summit that is scheduled for this weekend but assuming the base case of amicable Xi-Trump relations and a broad agreement to resume US-China trade talks, we do not believe that development is strong enough to sink the precious metal below $1,400/oz.

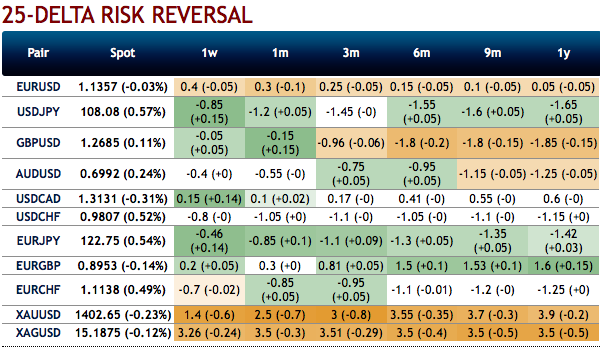

OTC Updates for Bullion Market: Please be noted that the positively skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, bids for OTM call strikes up to 1500 signifies hedging sentiments for the higher price risks. One could also see a bullish risk reversal setup. To substantiate the above bullish sentiment, risk reversal (RRs) numbers indicate an overall bullish environment.

The above risk reversal numbers have been known as a gauge of gold’s underlying market for bullish opportunities. Well, we know that options are predominantly meant for hedging a probable risk event in the future.

Options Strategy: Capitalizing on the minor shift in risk reversal numbers of gold in the short-run and bullish neutral risk reversals of longer tenors, we advocate longs in gold via ITM call options.

Buy 3m XAUUSD ATM -0.70 delta calls on hedging grounds. If the expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, we advocated long positions in CME gold contracts. We now like to uphold the same strategy by rolling over the contracts for July’19 delivery as we could foresee more upside risks. Courtesy: Sentrix & OCBC

Currency Strength Index: FxWirePro's hourly USD spot index was at -17 (mildly bearish) while articulating (at 08:39 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays