In this write-up, we emphasize that EUR-cross vols and correlations should cool as data and price momentum rotates away from the Euro. Buy EURUSD vs. EURPLN vol spreads and sell EURNOK – EURSEK correlations.

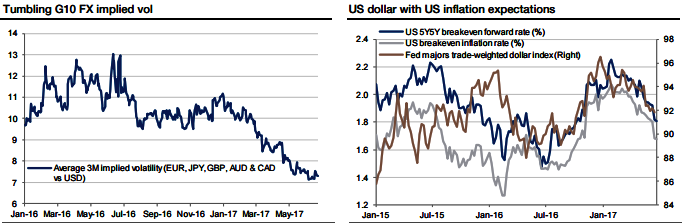

The summer solstice last week was marked appropriately by year-to-date lows in FX implied volatility (refer above chart). The summer doldrums have thus descended on the FX market. It is difficult to see what would stop the market being lulled into a deeper slumber in coming weeks. No doubt the volatility decline cannot keep going on, but it is a mug’s game to speculate exactly when and why it will spike.

Meanwhile, the EU’s insistence on the ECJ as the legal arbiter of EU migrants’ rights after Brexit is emerging as the first bone of contention in the Brexit negotiations.

The ECB forum in Portugal this week will feature a slew of central bank speakers, with the persistence of disinflationary pressures being a key consideration. Fed Chair Yellen will be making remarks in London too. We will also get the latest consumer inflation readings from the Euro area (EA), Japan and the US (in the form of the PCE deflator) this week.

The list of key market events this week includes:

June 27: US Conference Board consumer confidence.

June 28: EA money supply, and the US pending home sales.

June 29: Germany CPI, and US 1Q GDP.

June 30: Japan CPI, China PMIs, France CPI, Germany employment report, UK 1Q GDP, EA CPI, Canada April GDP, US personal income & spending, US PCE deflator, and UMich consumer sentiment. n The revival of disinflationary pressures is negative for the US dollar, which has demonstrated a positive relationship with US inflation expectations in recent quarters (refer above chart).

Based on rate differentials and positioning data, however, EURUSD still looks overdone on a tactical short-term perspective. We stick to our bullish EURUSD medium-term view and recommend buying the pair on dips to 1.10-1.11. The technical analysts highlight technical support for EURUSD layered just under 1.11. With alleviating EUR downside risks, and given frequent flips in the EURUSD skew before the Fed/ECB QE era, positive EURUSD risk reversals are an increasingly likely development.

Buy EURUSD 6m call strike 1.15, European KI on the realized volatility at 9% Indicative offer: 0.60% (vanilla: 1.61%, volatility swap: 7.6%, spot ref: 1.1273).

Meanwhile, EURNOK has held under its one-year ceiling at 9.59 as crude oil prices find support near the $40/bbl mark. With the Norges Bank shifting to a neutral policy stance, selling EURNOK above 9.50 appeals to us. EUR-cross vols should be more muted in H2 as data momentum and investor focus on Europe cools. Buy 2M 25D EUR call switches in EURUSD vs. EURPLN and sell EURNOK – EURSEK correlations via a vanilla option triangle.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate