The industrial production in the UK dropped by 1.3% MoM in October, dramatically undershooting our and consensus expectations, building on a 0.4% MoM contraction in September. Within overall production, manufacturing output also dropped by 0.9% MoM, more than reversing a 0.6% MoM gain in September.

It was the sharpest decline since September 2012, as mining and quarrying fell sharply, dragged by oil and gas extraction; and manufacturing output also shrank, mainly due to a contraction in pharmaceuticals. Furthermore, sterling’s export-supportive declines notwithstanding, an export-led boost and rebalancing away from services and the consumer still seems relatively distant on these data.

Just until recent times, the many analysts had been expecting the RBA to sit tight at 1.5% cash rate for some time and the central bank also delivered as anticipated.

But in contrast, the Australian economy unexpectedly declined 0.5 pct in the Q3’2016, compared to an upwardly revised 0.6 pct growth in the June quarter and missing market consensus of a 0.3 pct expansion.

As a result, the RBA’s monetary policy would remain expansionary; a more easing cycle is on cards. In other words, the Aussie central bank members can make the most of the summer break, rate hikes in Australia are not foreseeable for now which would imply that the more bearish pressures on AUD.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

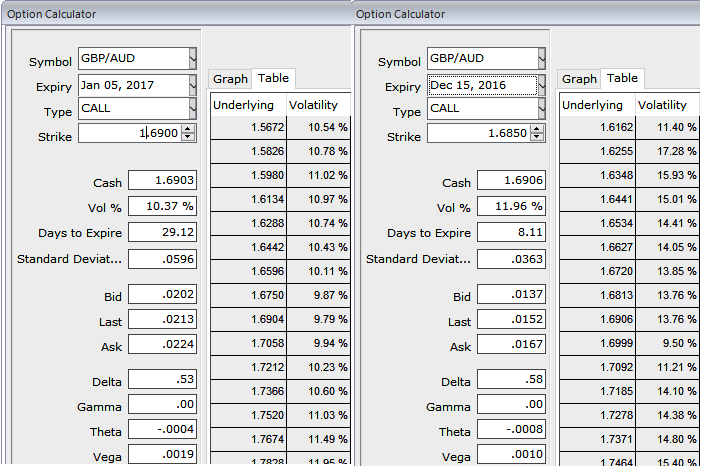

Rationale: The current implied volatility of GBPAUD 1w ATM contracts is just shy below 12%, and it is likely to shrink below 10.5% for 1m tenors as shown in the IV nutshell, shrinking IVs is conducive for over-priced option writers. Option writers of expensive calls with 1m expiries would be on competitive advantage.

The execution of the strategy: Go long in GBPAUD 3M at the money -0.49 delta put, long 3M at the money +0.52 delta call and simultaneously, Short 1m (1.5%) out of the money call with positive theta or closer to zero.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist