As the dust settles around the UK general election, in which PM Johnson’s Conservative Party won a healthy majority, the focus is now on the next steps for the government. Speculation remains high that Mr Johnson could announce some changes to his cabinet today, particularly to take into account those members that are no longer MPs. However, over the weekend, news reports suggest that more sweeping changes are likely to wait until after the UK leaves the EU at the end of January. Parliament is due to be summoned tomorrow, when MPs will be officially sworn in, with the Queen’s Speech due to take place on Thursday. Here, the Prime Minister will lay out his legislative agenda, with a focus on “getting Brexit done”, which will likely see the government bring the Withdrawal Agreement bill back for a vote before Christmas.

For now, the focus would be on the ‘flash’ UK PMIs for December. In the November releases, manufacturing and service sector companies noted that domestic political uncertainty had weighed on business and consumer activity. The extent to which the election result has cleared up some of this uncertainty will not be captured by these releases, given their early publication. Nevertheless, we predict improvements in both the manufacturing and services PMIs to 49.6 (from 48.9) and 49.5 (from 49.3), respectively. These levels would be consistent with a small contraction in GDP growth, though the survey has overestimated the weakness in activity this year. Our own measure of business confidence, the Lloyds Business Barometer is released on Friday.

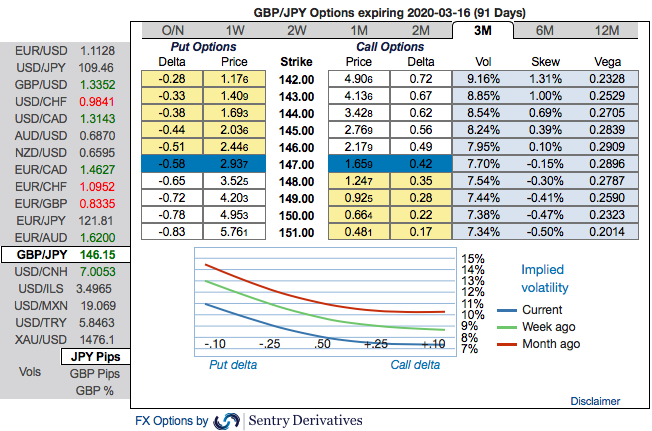

The GBPJPY was volatile yesterday, appreciating to just shy of $146.130 after reports of a Brexit deal agreement. Currently, trading with little exhaustiveness, still, it is well up from last week’s lows.

Even so we believe it worthwhile increasing our bearish beta to GBP through re-selling GBPJPY (our single most successful trade to date this year).

OTC outlook and Hedging Strategy: The implied volatility of this pair that display the highest number among entire G7 FX universe.

While the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 142 levels (refer above nutshell).

Accordingly, put ratio back spreads (PRBS) are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on current abrupt and momentary price rallies and bidding theta shorts in short run, on the flip side, 3m skews to optimally utilize delta longs.

The execution: Capitalizing on any minor upswings , we advocate shorting 2m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options (spot reference: 146.18 levels while articulating).

The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1 or 3:2, to maximize returns. Courtesy: Sentrix & Lloyds

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure