The dollar tended to strengthen in the past few rounds of trade tensions; however, at this juncture dollar has been falling like a stone although the US-China relations are sour. Putting this into CNY's perspective, this will translate into a somewhat lesser depreciation pressure versus USD, while the sentiment might still drive the Chinese currency to the weak side.

As a result, CNY will depreciate more against non-USD currencies, such as EUR. For those operating in China while importing machines from Germany, this is certainly not a piece of good news.

However, for the Chinese authorities, this might create a "sweet spot" for them - They don't need to worry about capital outflows that could be triggered by expectations of large depreciation, and a relatively weak currency would benefit the export sector which actually employ millions of workers. All told, there seems no directional trend for the CNY but downside risks in the medium-term.

OTC Outlook & Hedging Strategy:

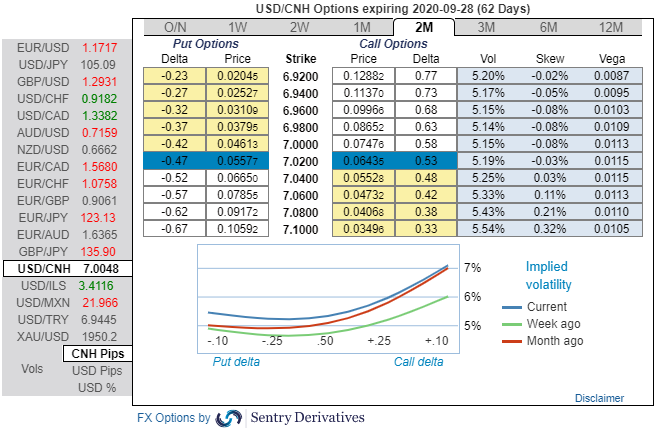

Please be informed that the positively skewed USDCNH IVs of 3m tenors still indicate the upside risks, they are still bids for OTM call strikes up to 7.10 levels.

At this juncture, we uphold our shorts in CNH on hedging grounds via 3-month (6.96/7.15) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations, (spot reference: 7.0048). Courtesy: Sentry & Commerzbank

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure