As the U.S. economic and foreign policies decouple from the rest of the world (President Trump’s stance on Jerusalem, NATO, Iran nuclear Agreement, Trans-Pacific Partnership, Paris Climate Accord), so do its economy and financial markets. After decades of globalist policies, under president Trump, it has taken a sharp turn towards nationalism and protectionism.

So far, it has been working out fine for the United States. U.S. economic growth hit 4.2 percent last quarter and Fed’s ‘GDP Now’ data shows that it was not a one-time event. The next quarter could be even better. This comes at a time when Europe is still struggling and weakness is visible in many emerging market economies.

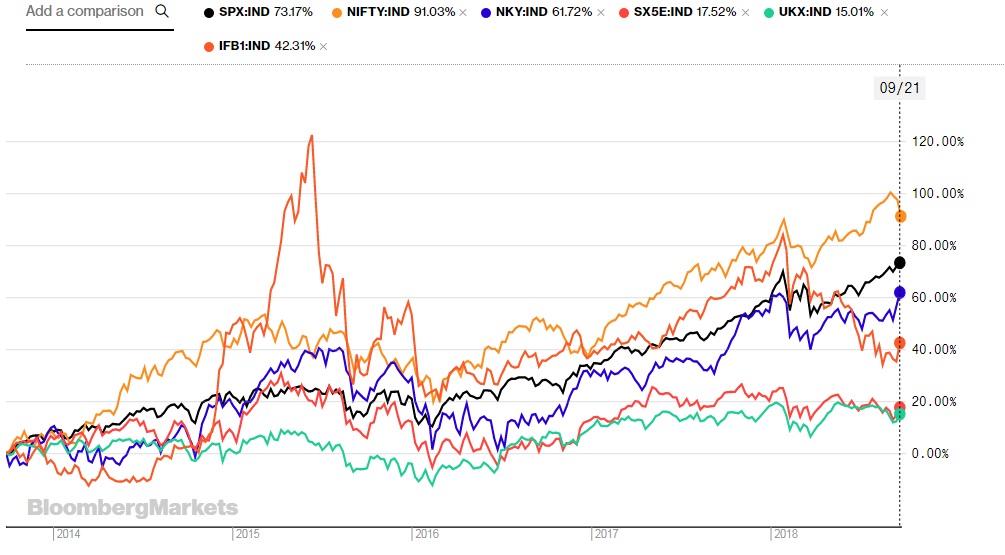

Similarly, U.S. financial markets have been decoupling from the rest of the world. So far in 2018, the U.S. benchmark stock index has returned +8.3 percent, whereas India’s nifty has returned +5.1 percent, Nikkei has returned +1.9 percent, Eurostoxx50 has returned -2.3 percent, same as FTSE100, and China’s benchmark CSI300 has returned -17.4 percent. This might seem just another outperformance, the trend is becoming more and more visible. And we believe that it is here to stay.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility